Impact

CDC Small Business Finance is a nonprofit with a passion for making a difference for small businesses. Over more than four decades we have helped over 12,000 small business owners get access to financing to help them grow and succeed.

We are committed to making an impact for small businesses of all sizes with affordable and responsible loans. Start-ups to seasoned companies and every small business in between can benefit from our financing programs.

Whether we are creating access to capital for the small business community or working with grantors and investors to raise funds, capital helps us make a great difference and increase our impact.

From meetings with elected representatives to supporting key legislation to testifying before congressional small business committees, we are a strong advocate for entrepreneurs.

We help potential loan candidates and current borrowers — pre and post loan. Our proven team of experts assist with business strategy, credit repair, financial planning and much more.

$1.8T

Revenue Generated by women-owned businesses

975,000

People employed by black-owned businesses

8,000,000

Number of minority small business owners in the U.S.

4.5%

People that have a business loan from a bank or financial institution

40%

Chance a Latino business owner is denied by a bank

5%

Amount of small business financing given to women

Using the Interactive Map

The map above is an interactive tool that allows you to see a wide variety of data about our lending over the last five years. You can view our impact by number of loans and dollar amount. The information can also be sorted by zip code, county and state.

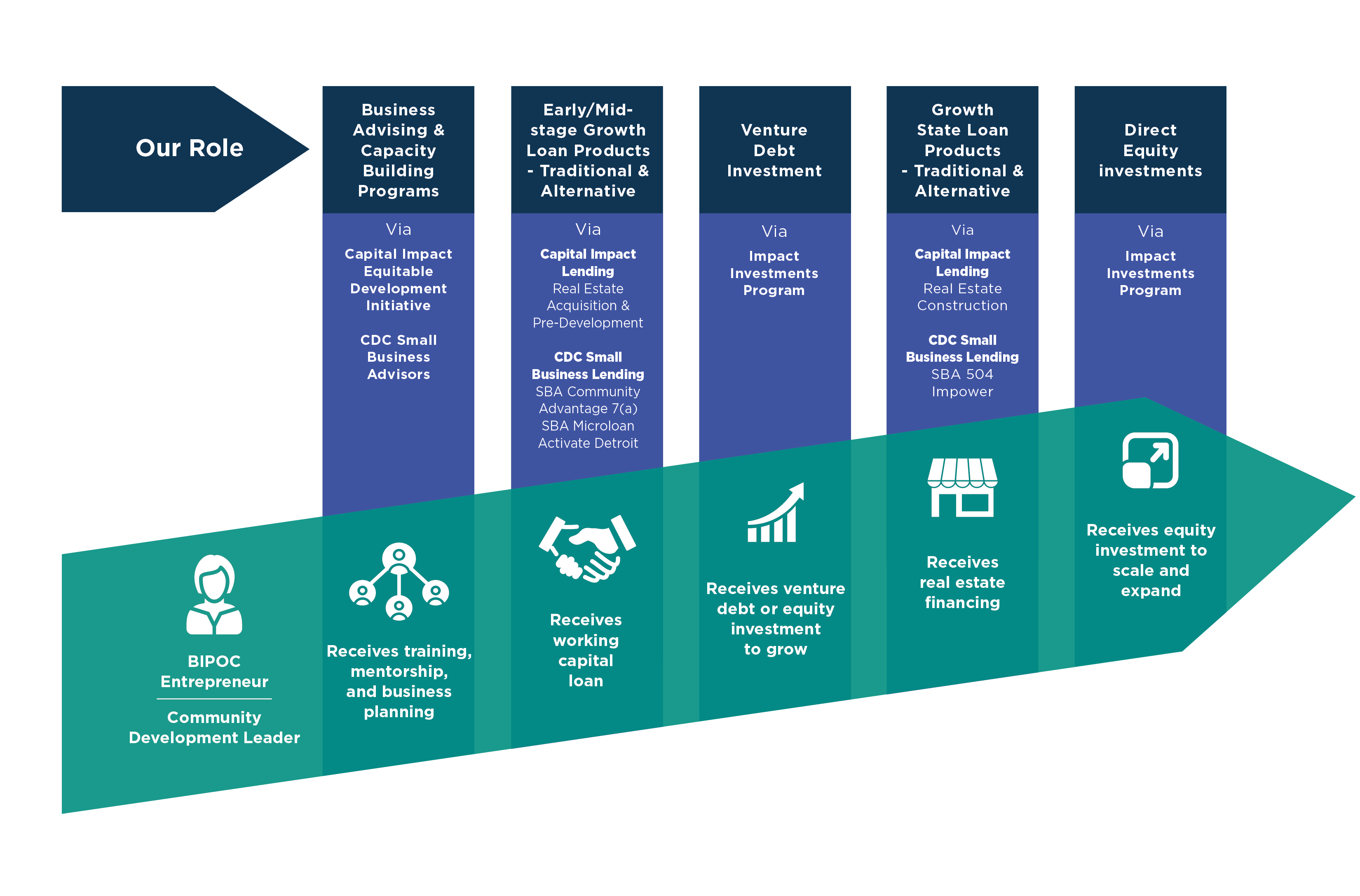

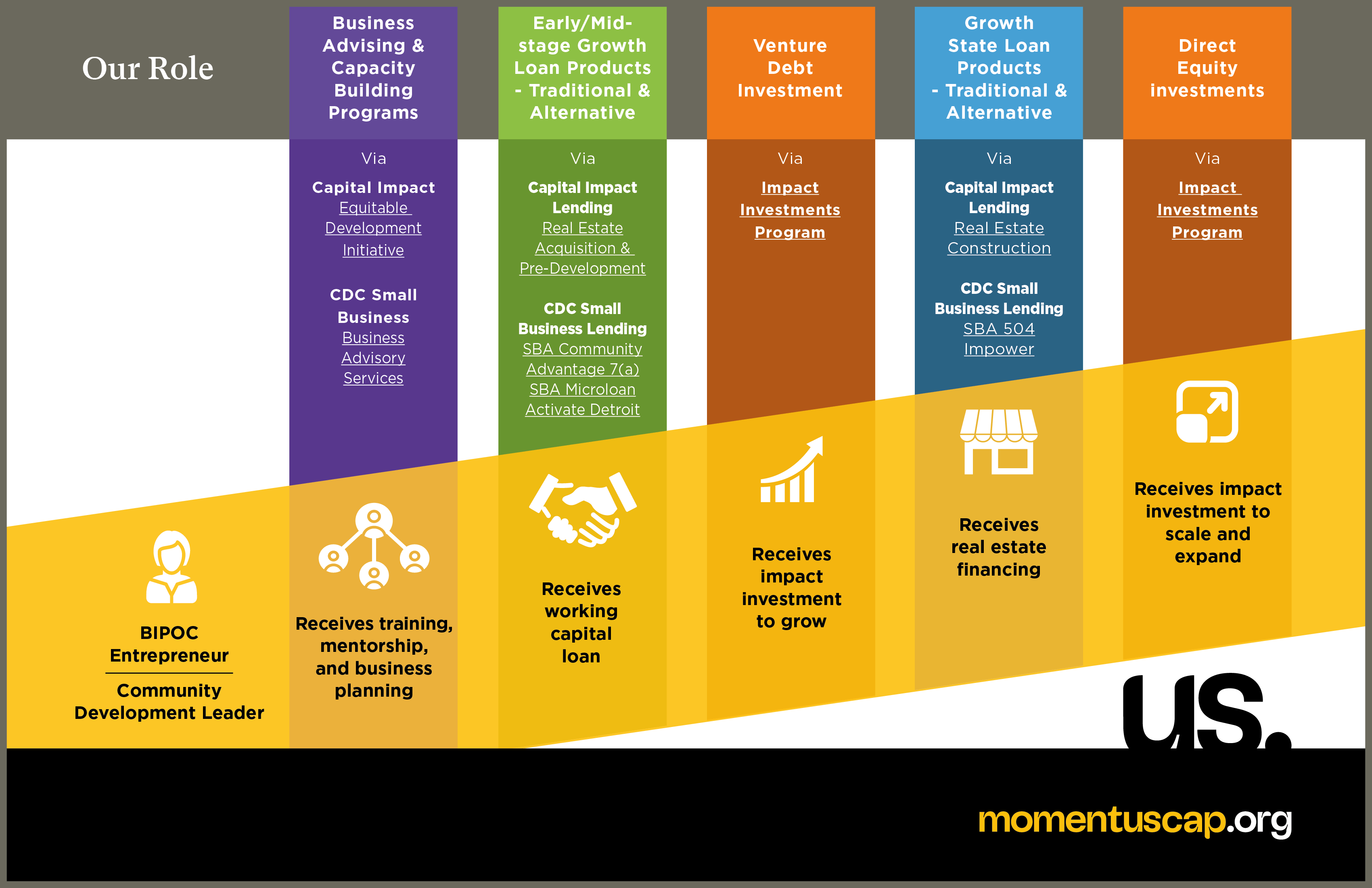

Create jobs and drive economic development in underserved neighborhoods

Provide small business owners access to responsible and affordable capital

Bridge the racial wealth gap through targeted programs and partnerships

Offer business advising to build financial acumen

Increase opportunities for commercial real estate ownership

In order to ensure that traditional and mainstream financial systems are equitably serving Black, Hispanic, and Indigenous communities to drive solutions that support economic mobility and wealth creation, we must think differently. Traditional tools and approaches have failed to address systemic issues of inequality and the widening racial wealth gap.

Realizing the need for a new approach, Capital Impact Partners and CDC Small Business Finance have formally united their operations to launch a transformative new enterprise and innovate how capital and investments flow into historically disinvested communities.

INTEGRITY + PASSION

Our unflinching commitment, for over four decades, has resulted in delivering affordable and responsible business loans to over 12,000 small business owners and counting…

Our History

INNOVATION

Our unflinching cross-department collaboration and research helps us smartly shift our processes and offerings to meet small business owners where they need help the most.

Learn About Our Lab

POLICY + ADVOCACY

We are committed to being a voice for entrepreneurs locally, regionally and nationally.

Learn more

Gratitude to our Grantors and Impact Investors:

We cannot accomplish our mission alone, nor could we impact small business owners

and their communities as deeply as we do without the commitment,

investment and belief of grantors and impact capital investors.

With Grant and Impact Capital, we are able to help business owners prosper,

create jobs, as well as drive economic development in underserved

neighborhoods all at a greater scale.

Impact Capital Investors

Goldman Sachs • Bank of America • Union Bank • CIT Bank

Support for over a decade

Bank of America • Union Bank • U.S. Bank

Government partners

Small Business Administration • City of Carlsbad

Grantors

Bank of America • Bank of Hope • Bank of the West

Banner Bank • BBVA • Cathay Bank

CIT Bank • Citizens Business Bank • City National Bank

Goldman Sachs Foundation • JP Morgan • Opus Bank • Manufacturers Bank

Mizrahi Tefahot (UMTB) Bank • Pacific Western Bank • San Diego Gas & Electric

Torrey Pines Bank/Western Alliance • Union Bank • US Bank • Wells Fargo

"Our thanks to Goldman Sachs 10,000 Small Businesses for providing over $125 million to CDC Small Business Finance to support access to the PPP loan."

SBA PPP Loan, Goldman Sachs 10,000 Small Businesses scholars and alumni

"I am extremely proud of our work to make a difference in the communities we serve."

Kurt Chilcott, CEO, CDC Small Business Finance

"We are proud to be a voice and advocate for small business owners in Washington D.C."

Robert Villarreal, Testifies Before The House’s Committee on Small Business