What we’re doing to close the massive financing gap for Latino small businesses in low- to moderate-income neighborhoods

CDC Small Business Finance borrower Rodnia Attiq (pictured above) is the co-owner of restaurant El Borrego. The eatery is located in San Diego’s City Heights area, deemed a low- to moderate-income neighborhood.

Pull aside any small-business owner and ask them to list off their biggest hurdles. Lack of capital and limited knowledge of business basics like crafting a business plan probably rank high.

What would minority, particularly Latino, entrepreneurs say? “It’s those two same things — but exacerbated,” said Robert Villarreal, executive vice president of leading lender and non-profit CDC Small Business Finance. He’s also president of the Small Business Finance Fund, a CDC affiliate and CDFI, or community development financial institution.

The power and promise of Latino entrepreneurs and small businesses in low- to moderate-income, or LMI, communities are undeniable. Study after study shows their immense size and potential. Just consider this stat: There are more than 4 million Latino-owned businesses in the U.S. and together they generate $660 billion in revenues. However, another study points out that this subset is growing at a slower pace compared to their non-Latino counterparts, resulting in a $1.3 trillion revenues gap.

As we observe SBA Small Business Week, which this year runs through May 5, we, as a non-profit lender, are spotlighting the key challenges these groups face in the communities we serve — and the unique solutions we and our partners have employed to give them the extra boost they need to succeed.

Challenge #1: Access to capital is limited for minority small business owners.

How we’re helping: Offering more loan options that meet different needs.

When it comes to accessing capital, minority business owners tend to tap their credit cards, limited personal wealth, and funds from family and friends before turning to a bank. In fact, more than 70 percent of Latino entrepreneurs follow this trend — and the rates are similar among Asian and black-owned companies.

Many times, these practices can hinder entrepreneurs when they need to obtain a small-business loan in the future, Villarreal said. For one, if they’re habitually using more than 30 percent of their available personal credit, then they’ll appear on paper to be overusing their credit resources. This can lower their credit score, which can affect the rate you pay for a business loan and even your chances of qualifying for one.

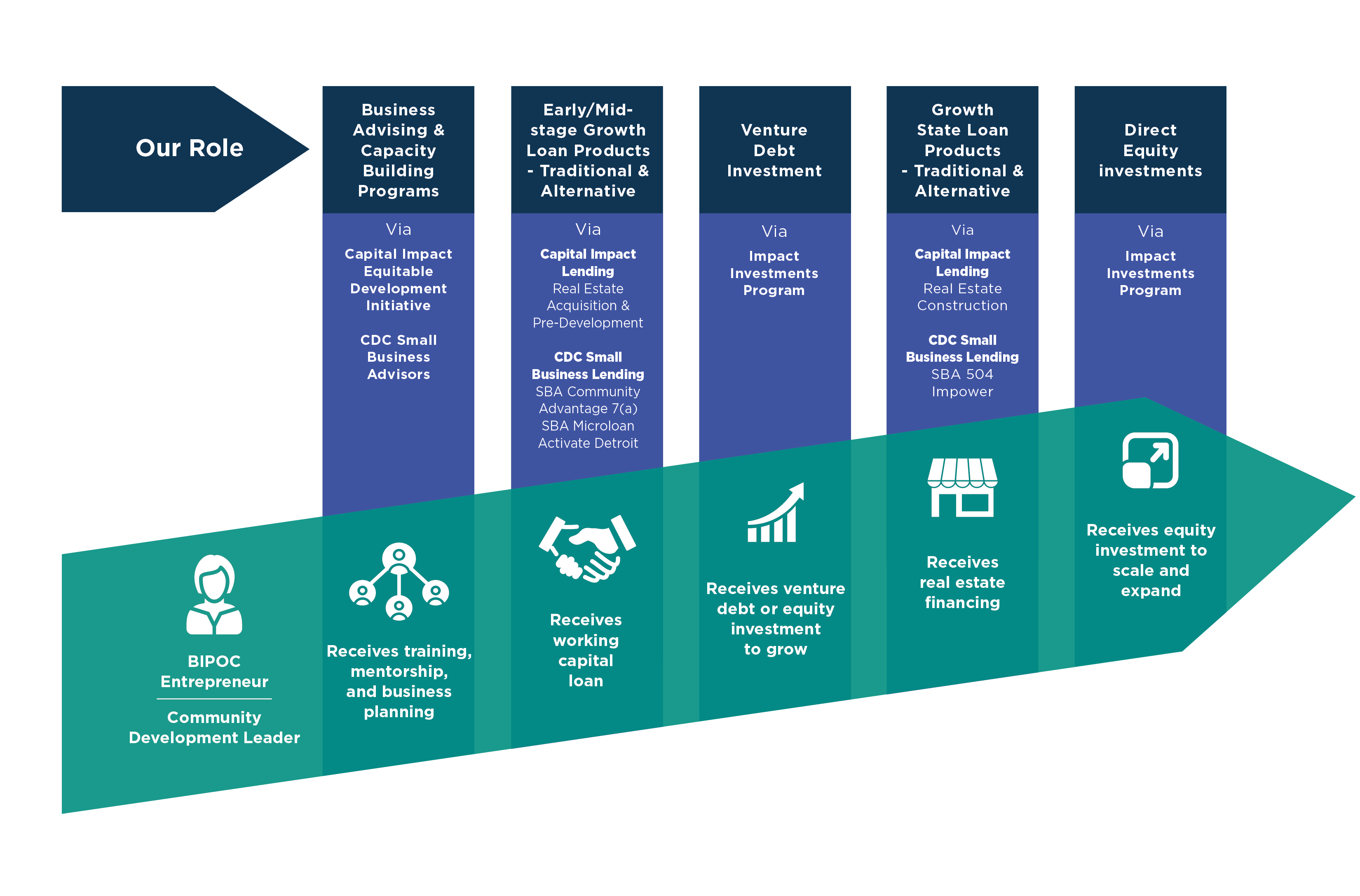

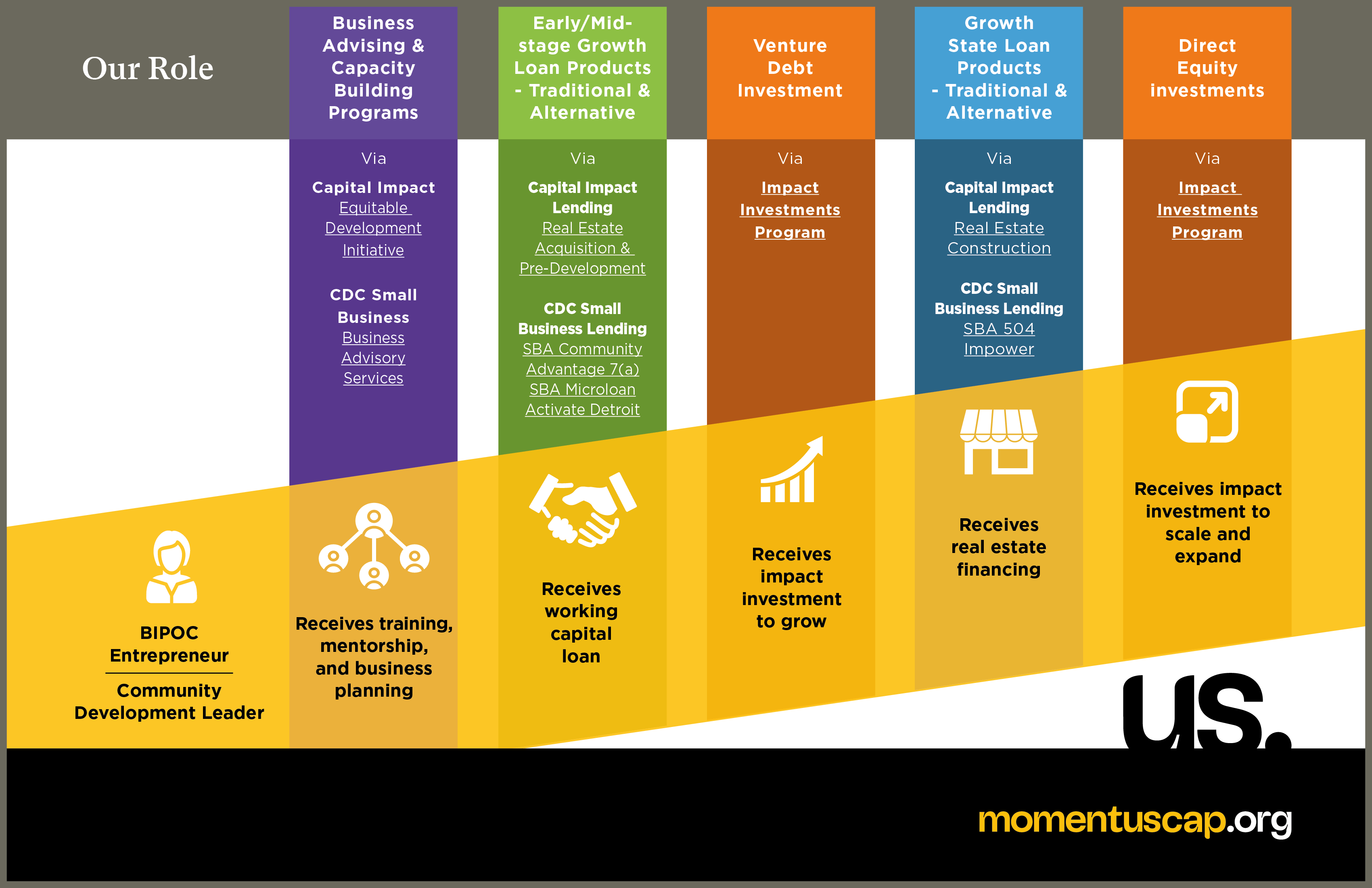

To help address this, CDC Small Business Finance offers a wide selection of loans for “businesses with different needs and on different points of their life cycle,” Villarreal said.

The SBA Microloan is specially designed for early-stage companies and startups while the Community Advantage loan is for more established companies. For business owners who need access to quick money, we created Fast Fund, which gives borrowers access to capital within five days of qualifying.

Last but not least, there’s our CDFI, or Small Business Finance Fund, re-branded last year to serve Latino and African American businesses in the Los Angeles area. Also known as LA Direct, this program offers more flexible prequalification guidelines compared to more traditional loan programs.

Features include:

- No minimum credit score

- 1 year’s business history, and

- Flexible underwriting terms

Challenge #2: Minority companies lack Business 101 skills, which limits growth.

How we’re helping: Providing personalized business coaching.

Recently, Villarreal and his team worked to get financing to a Latino-owned transportation firm in Los Angeles that recorded $3 million to $5 million in annual revenues. While they were performing well business-wise, their accounting and bookkeeping was still being done by a family member.

“She did as well as she could,” Villarreal said. “But the company reached a great level of sophistication so they now needed a part-time bookkeeper or a more active role for their external CPA.”

This is a pretty common anecdote in the realm of minority small-business owners. And this is where CDC’s business-advising experts can help — at no cost to the client. The in-house team helps identify pain points and directs potential borrowers to solutions and resources to get them loan ready, from business-plan writing to creating realistic projections. These advisors are also there post-funding to ensure the borrower is set up for long-term success.

CDC’s CDFI Los Angeles program — managed by financing veteran Antonio Pizano — is expected to meet or exceed expectations in 2018, thanks in part to a strong pipeline of leads from partners including banks and the Chamber of Commerce, Villarreal said.

Challenge #3: Minorities are falling victim to predatory lenders.

How we’re helping: Refinancing the loan and providing education.

So far, half of the recipients of LA Direct loans have taken out high-interest, predatory loans, Villarreal said. In one case, a business owner agreed to a $31,000 loan through an online lender with a 39 percent interest rate to be paid off over 10 years. If the client had kept with that schedule, they would have paid a total of $92,000 in interest, or three times the loan amount.

In such cases, CDC or the CDFI can sometimes refinance the loan, giving the borrower a more reasonable loan with a lower interest rate and transparent terms. In some cases, taking out a higher-interest online loan may make sense. But in most cases, this type of financing could end up imploding your business finances.

“It goes back to the education piece,” Villarreal said.

Challenge #4: Government contracts are not being filled with enough minority subcontractors.

How we’re helping: Building the bridge between the two parties.

Did you know? Federal law requires the government to set aside a specific percentage of its contracts for minority-owned small business suppliers? Unfortunately, these quotas oftentimes aren’t met. This means unclaimed opportunities for those who may need them the most.

CDC Small Business Finance is part of a Los Angeles-based collaborative designed to help connect more minority firms with opportunities – including contracts, financing and business counseling.

The collaborative is working under the Ascend 2020 umbrella, a CDFI initiative spanning six cities that’s funded by JP Morgan Chase. CDC’s direct partners in this project include UCLA’s Harold and Pauline Price Center for Entrepreneurship and Innovation, and Pacific Coast Regional, a small business development center and CDFI lender.

The Southern California project is still in the planning phase. But if successful, there’s possibility for expansion, Villarreal said.

The Takeaway

Villarreal feels encouraged by the progress logged by CDC and its trusted partners. But ultimately, “there’s a lot of work to be done,” he said. Limited to no capital and business knowledge remain issues for minority business owners.

But his optimism is buoyed by progress in programs including LA Direct and a steady stream of studies reflecting continued positivity in these communities. Just this year, Bank of America released a report stating 77 percent of Hispanic business owners plan on growing their business over the next five years. That’s compared to just 50 percent among their non-Hispanic peers. And a study released last year by CDC Small Business Finance, in collaboration with the National Association of Latino Community Asset Builders, or NALCAB, suggests that CDFIs and non-profit lenders can be a significant solution to financing Latino entrepreneurs.

CDC Small Business Finance offers several loan options for business owners who want to start or grow their business. As a non-profit organization, our mission is to support those who face the greatest obstacles in securing capital. They include women, minority and veteran-owned businesses in California, Arizona and Nevada.

Tell our loan experts about your business. They’ll work to match you with a financing plan that best suits you.