Latinas Leading in Female Business Ownership

This specific group is behind a slate of impressive feats: creator of 11 million firms nationwide, major jobs producer, and generator of $1.6 trillion in annual revenues.

Can you guess the identity of this mighty force? The right answer: women. And within this growing contingent, one particular group has recently witnessed extraordinary growth. The number of Latina-owned businesses has shot up from 800,000 to 1.5 million — an 88 percent increase, based on a 2016 report from the U.S. Department of Commerce. That recent surge marks the biggest uptick in female business ownership of any race or ethnicity.

Other eye-opening statistics:

- Almost half of Hispanic-owned companies are owned by women, based on Census data.

- As of 2016, there were just under 1.9 million Latina-owned firms, employing 550,400 workers and generating $97 billion in revenues, according to this report.

Strengthening Latina-owned businesses

While those gains are certainly cause for celebration, there’s still room for growth.

One study out of Stanford Graduate School of Business shows the most common source of funding for Latino-owned businesses was personal funds such as savings and loans from friends or family. In most cases, loans or venture capital were not explored at any stage of development — revealing a potential source of opportunity for small-business lenders and their trusted partners.

“This provides an opportunity for banks and commercial lenders to better engage Latino business owners, especially those that have been in existence for multiple years, as it is crucial to growing the strength of our Latino-owned businesses,” the study points out.

If past numbers are any indication, it’s clear that the Latina-owned business segment is rich with opportunity for small firms and lenders alike.

Growing your business?

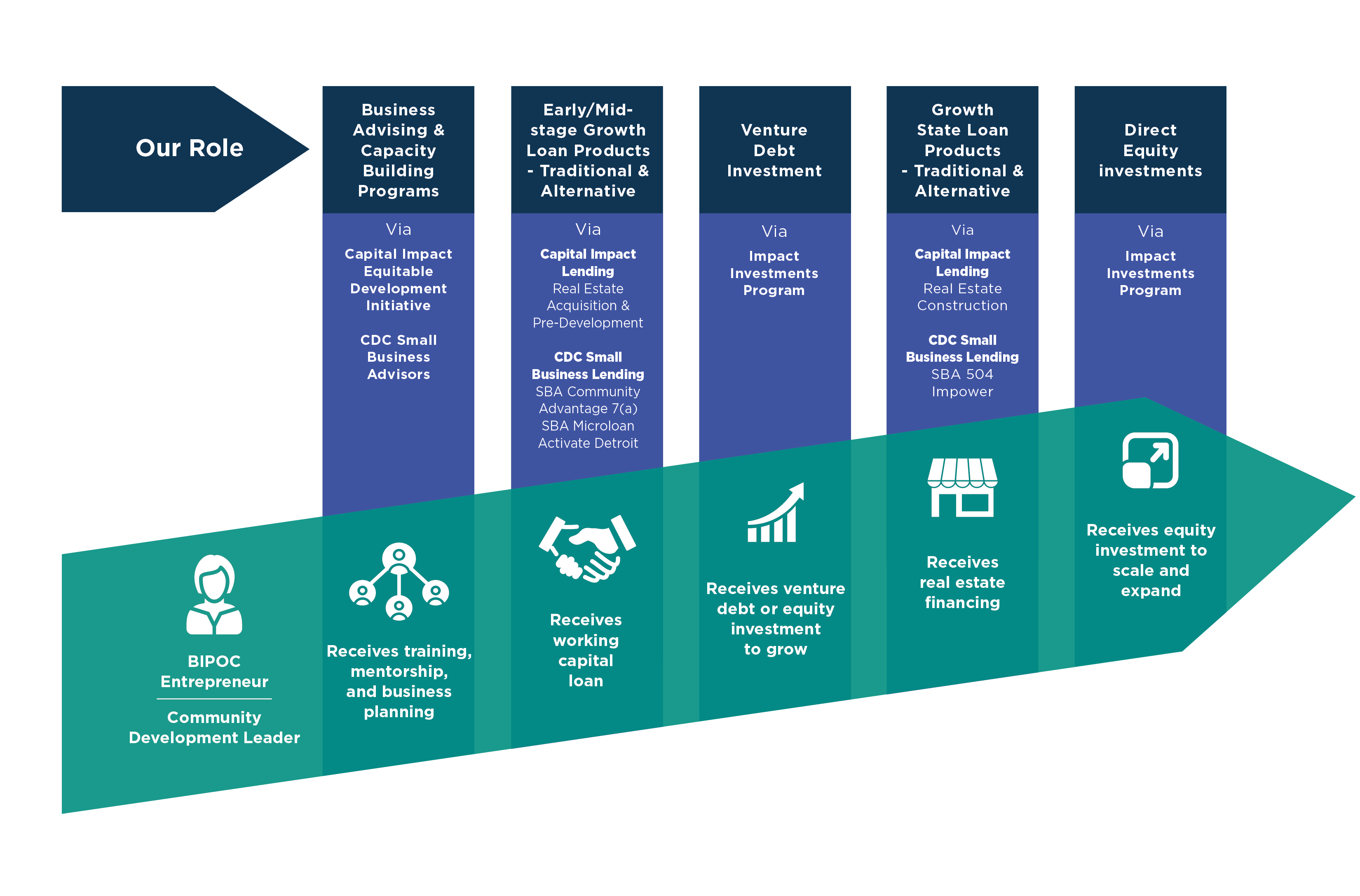

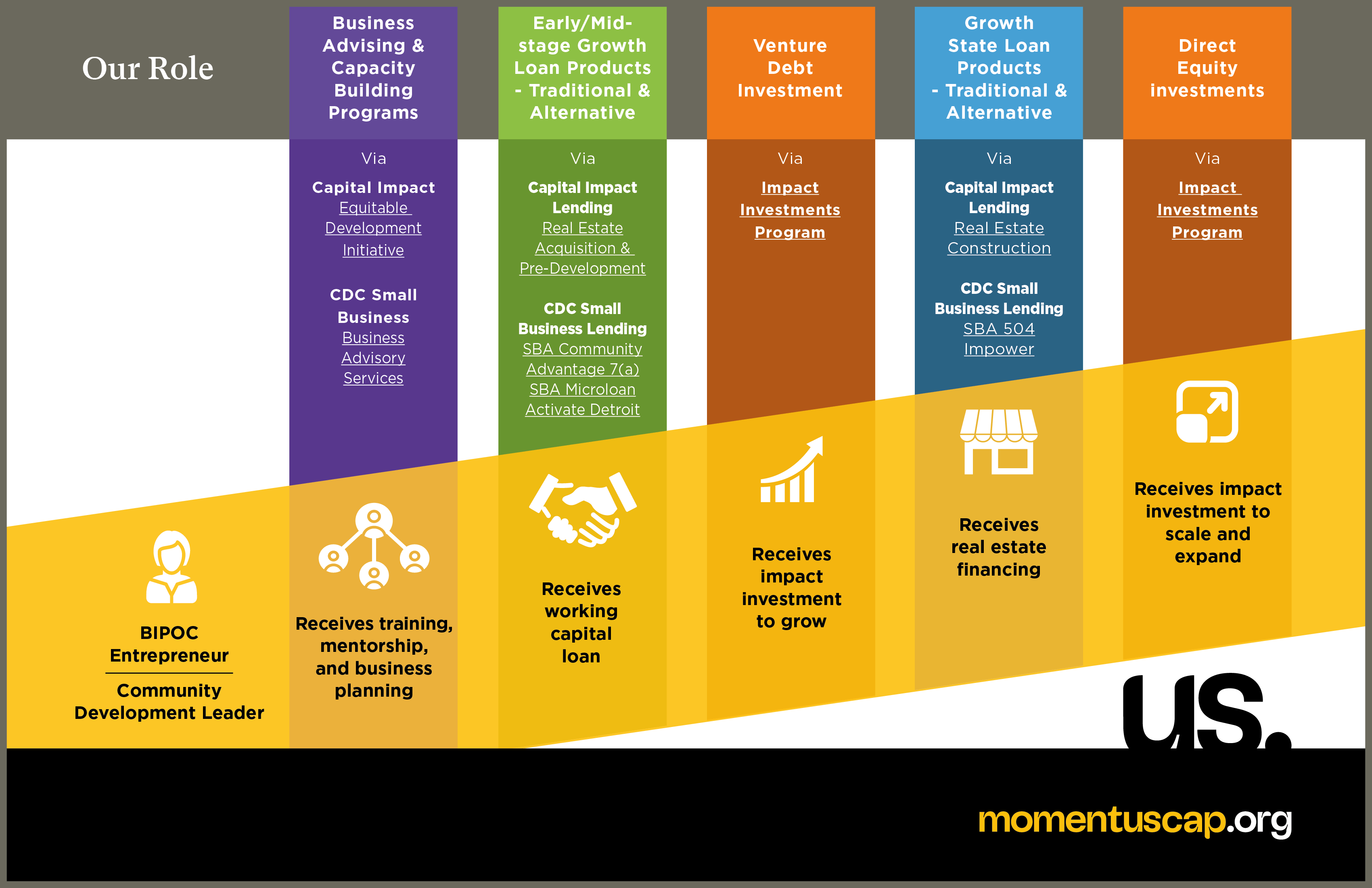

CDC Small Business Finance offers several loan options for business owners who want to grow their operations and are planning for their long-term needs.

“CDC provides both capital but most importantly business advising to assist Latina and Latino entrepreneurs,” said Robert Villarreal, senior vice president of community development at CDC Small Business Finance.

Tell our loan experts about your business, and they’ll work to match you with a financing plan that best suits you. Let’s talk! Reach us at loaninfo@cdcloans.com or (800) 611-5170. Learn more about how our Business Advising Services can help you get loan ready.