Small Business Loan Gives Urban Winery Leverage to Expand

Magdalena Wojcik and Michael Keller had talked many times about turning their passion for wine-making into a small business, but inevitably they ended each conversation with: “We’ll just do it when we retire.” But multiple trips to wine regions around the world stirred their excitement until they could no longer put their dreams on hold.

“Why wait?” was the rhetorical question that motivated the couple to team up with friend Chris Payne and launch The Blending Lab, an urban winery in the heart of Los Angeles in late 2016.

“There are dozens of craft breweries in L.A., but only a handful of urban wineries, so we believed our idea would take root,” said Magdalena.

Gradual business growth evolves into good traction

Knowing that opening a business can be financially straining, especially during the 1st year, the partners purposefully

The Blending Lab owners (from left): Michael Keller, Chris Payne, Magdalena Wojcik

kept their day jobs in professional marketing, while managing and personally overseeing all aspects of the winery business. The initial concept was to start slow, offering wine-blending classes and private corporate events. By the time The Blending Lab opened its doors in one of L.A.’s more renowned neighborhoods, the partners were making their own wine and becoming the city’s first winery tasting room to come along in years. Word of The Blending Lab’s wine experiences spread, classes started to sell out and gift card sales soared.

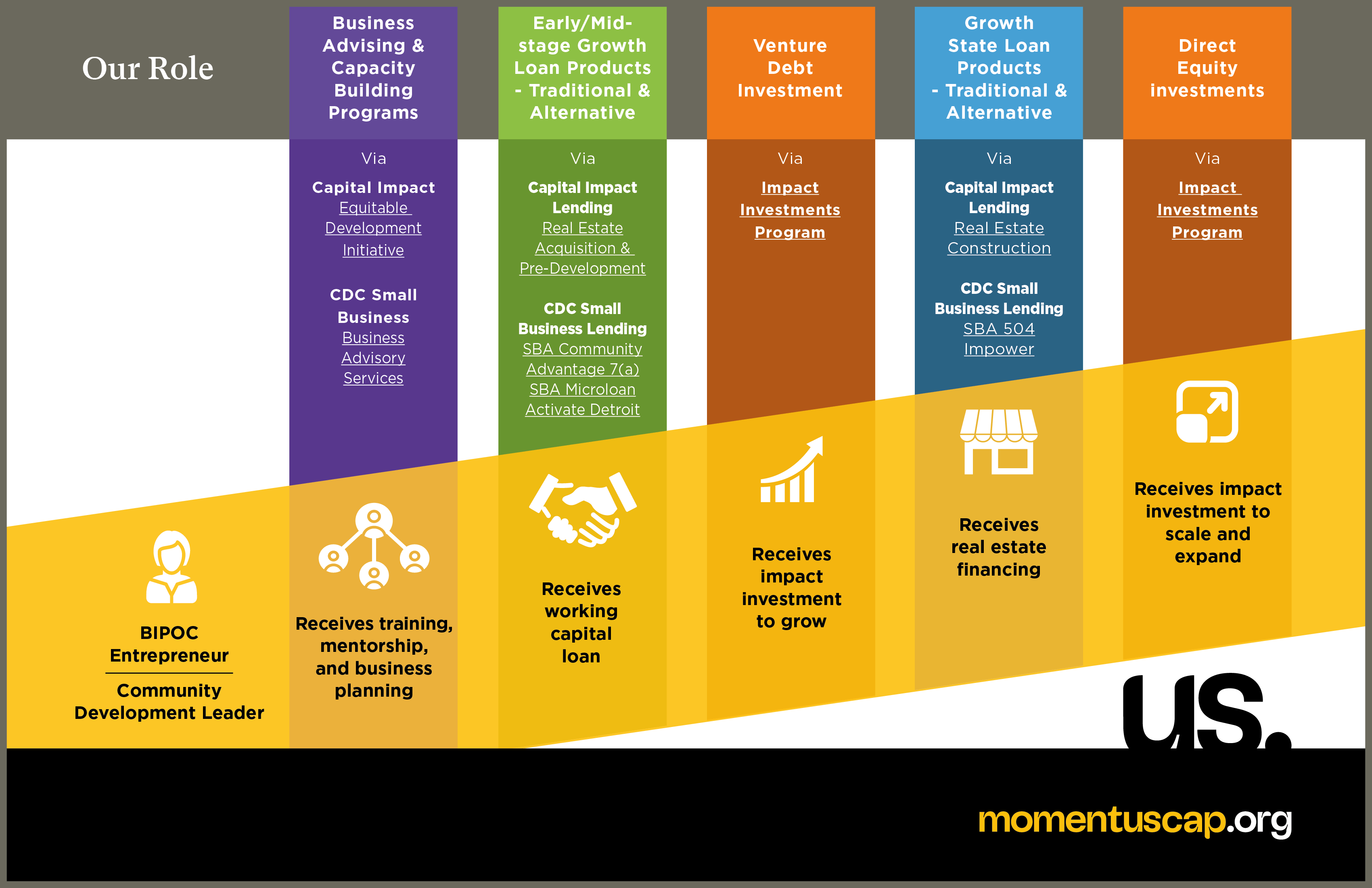

Long before the tasting room opened and before any income started coming in, they had leased a facility and purchased equipment and grapes from Paso Robles, one of California’s more dynamic wine regions. That’s when their overhead started to climb and they knew they couldn’t grow the way they wanted to without an injection of cash. Their first two requests for a business loan were turned down by national banks. Then Michael met with a community bank that recommended CDC Small Business Finance, a nonprofit lender that then approved a $129,000 SBA Community Advantage loan. They used the business loan for working capital and to buy equipment and pay their facility lease.

SBA loan comes in time to leverage expansion

Wine club members are called “Winegelenos”

“Initially, we were reluctant to get a loan,” said Magdalena. “But in the end it was the right thing to do and the

financing came just at the right time when we needed it most. It was a life-saver.”

CDC Loan Officer Stacey Sanchez, who assisted Magdalena during the loan process said: “I loved the concept of this business and it was great to be a part of such a unique company.”

Although The Blending Lab is not even two years old, it has attracted a loyal following. More than 100 Angelenos have become “Winegelenos,” the name given to members of the lab’s wine club.

Advice for new entrepreneurs

Looking back on their short tenure as small business owners, Magdalena and Michael are eager to offer advice to fledgling entrepreneurs who happen along.

“Be a dreamer and a realist at the same time. And know that if you love something, the dollars will follow.”

Magdalena Wojcik

Co-owner, The Blending Lab

“You need to have the patience to wait for the growth to find you, which means you need to have enough capital to sustain the blows to liquidity that building a business from scratch requires,” said Michael. “As you build, pay attention to diversification of how you sell products and services to meet market needs. If consumers don’t initially understand your business, give them enough relevant, attractive options so they can support you.”

Added Magdalena: “Find good partners who lift you up during the challenging times. Be a dreamer and a realist at the same time. And know that if you love something, the dollars will follow.”

True to her advice, Magdalena is in love with exploring new wine varietals – like Grenache and Tempranillo – which she and her partners plan to introduce to their loyal and new fans. And optimistically, she is already anticipating the need for a larger loan to further grow their small business dreams.

CDC Small Business Finance offers several loan options for business owners who want to grow their operations and are planning for their long-term needs. Tell our loan experts about your business, and they’ll work to match you with a financing plan that best suits you. Let’s talk! Reach us at loaninfo@cdcloans.com or (619) 243-8667.

In case you missed it, here are a couple other inspiring stories of small business growth:

Women Entrepreneurs: Here’s Practical Advice from 5 Wildly Successful Female Founders

Bike Shop Steers to Growth with Technology and Customer Service