Why more women aren’t getting small business loans – and how to even the playing field

While we’re surrounded with insights into why women-led businesses are shut out of venture capital funding, we still don’t know much about why female entrepreneurs struggle to secure small business loans.

This demographic accounts for almost one-third of all U.S. small businesses. Yet, women business owners are only getting 16% of conventional small business loans and 17% of SBA loans, this SBA study shows.

That’s where the Wisdom Fund comes in. Led by financial investment startup CNote and community lender CDC Small Business Finance, this novel partnership was designed to reverse the course of this troubling trend. The Wisdom Fund draws on the expertise of nonprofit lenders and capital from investors to help more women-owned businesses get the debt financing they need to succeed.

“Women, particularly women of color, are among the fastest-growing groups of business owners in the U.S. yet they’re severely under-capitalized,” said Allison Kelly, senior vice president of strategy and innovation at CDC Small Business Finance.

“What a fabulous opportunity this is to support lending to more low-income and minority female entrepreneurs through this initiative,” added Kelly, who is co-leading the Wisdom Fund project.

How does the Wisdom Fund work?

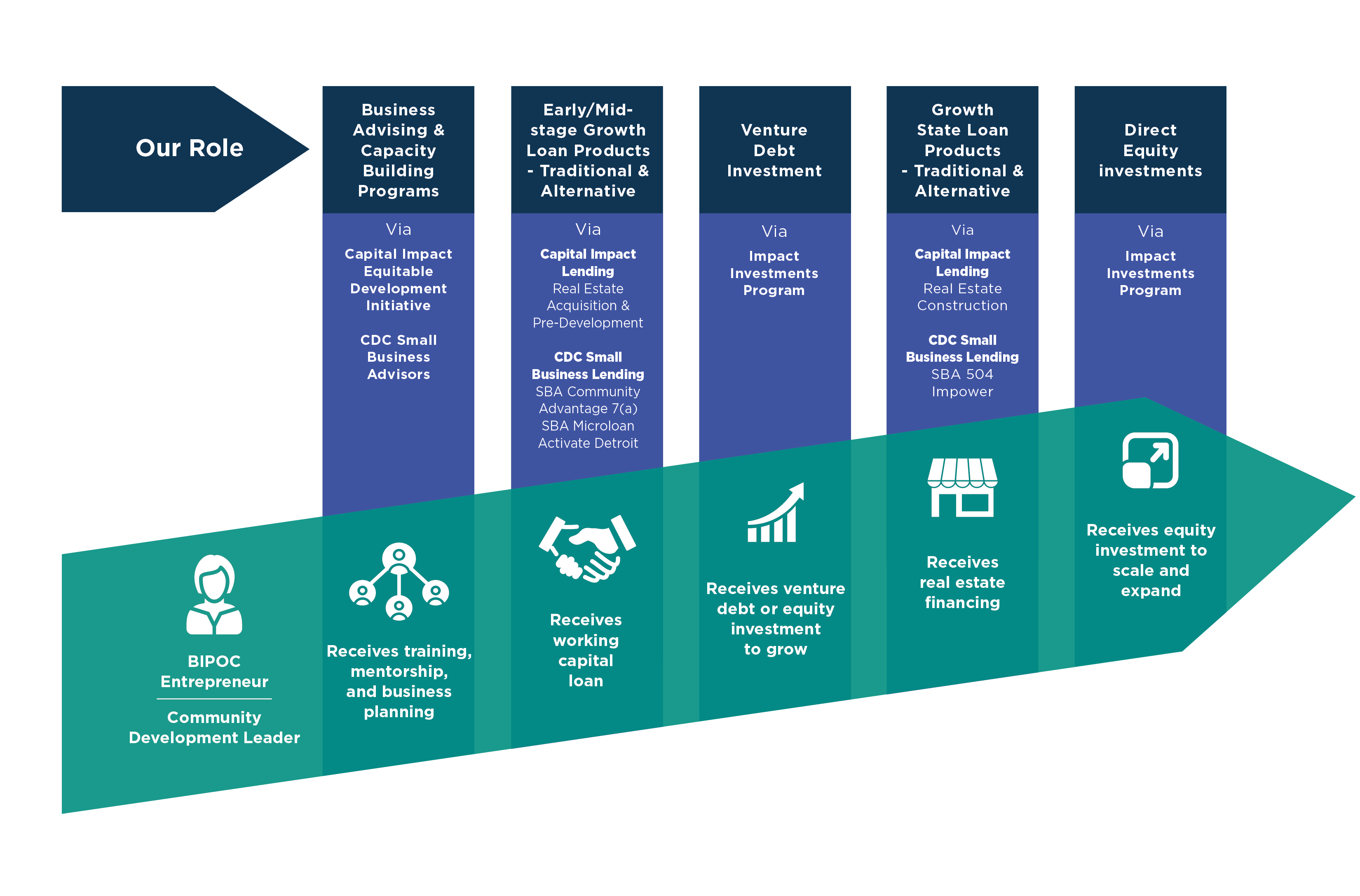

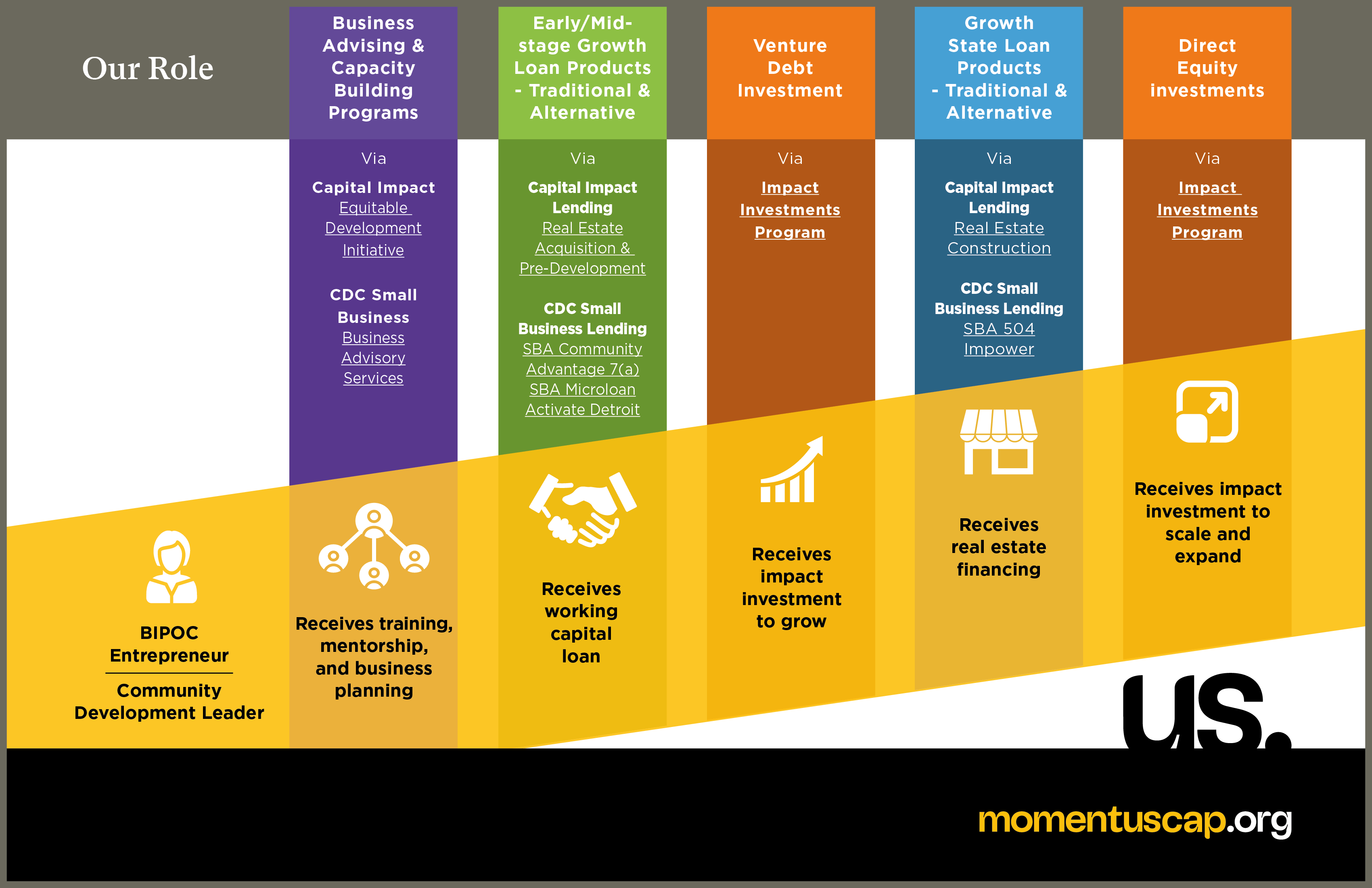

With the teamwork of CNote and four community lenders, the Wisdom Fund directs money from accredited investors to underserved female entrepreneurs in the form of affordable business loans. The specific target is minority women and women in low- to middle-income areas.

CNote will serve as the lender while the community nonprofits will facilitate the loans and other support to help the borrowers succeed.

Related: How to take women-owned businesses to the next level

“With the Wisdom Fund, we’re taking a major step toward fixing a huge injustice. Women’s businesses receive far less funding than they deserve,” said Cat Berman, co-founder and chief executive of CNote.

“We’re working with an amazing group of nonprofit community lenders nationally to entirely rethink lending to women,” she added.

What do we know so far about business lending to women?

One of the Wisdom Fund’s pillar goals is to establish where female entrepreneurs stand now, in terms of business financing.

Turns out, there’s a major disparity between the percentage of female entrepreneurs who are getting business advising and the percentage of those getting funded, according to a study commissioned by the Wisdom Fund.

The study focused on data from a sample of CDFIs, or community development financial institutions. These organizations deliver responsible, affordable business lending to disadvantaged communities. And part of their services usually include free technical assistance — or business coaching — to their small business clients.

Perhaps the most notable finding: While women received 50% of the technical assistance, only 38% of the loans went to women-owned businesses, according to the reported data.

Why aren’t more women getting funded?

Allison Kelly

How do you explain the difference in those rates? Kelly, of CDC Small Business Finance, says this question merits more investigation but some theories include:

- Having lower net worth. Women generally have less wealth and assets than men, and both can play important roles in securing certain types of business financing.

- Being more risk averse. Women are less likely to commit to debt until they reach a level of confidence that they can repay it.

- Lack of confidence. Female entrepreneurs tend to be more conservative about their business projections than men. Lower projections can affect qualifying for a business loan.

- Concentration in certain Industries. More women tend to be in service industries. Loans to these types of businesses can be more challenging to underwrite due to the lack of collateral.

What questions should we be asking?

By having the baseline findings in place, the Wisdom Fund partners can now perform additional research to explore:

- Why a lower proportion of women are getting funded.

- How to create loan products and services to better serve female entrepreneurs, and

- New language to better communicate with women business owners seeking financing.

“It comes down to creating parity in access to capital for all and figuring out new ways to do that,” Kelly said.

Why is CDC involved in the Wisdom Fund?

The Wisdom Fund’s mission and CDC‘s decades-long mission of advocating for the underserved go hand-in-hand. Since 1978, CDC Small Business Finance has provided low-cost, responsible loans to all entrepreneurs, including women of color and low-income women.

Related: How we can bring CDFIs into the 21st century

“Now, with the Wisdom Fund, we’re looking at ways to increase that type of lending more broadly by building a network that also supports this mission,” said Kurt Chilcott, CDC’s long-time chief executive.

How can I help?

Are you interested in making a difference in the lives of female entrepreneurs? The Wisdom Fund fundraising effort is currently underway.

If you’d like to become an investor in the Wisdom Fund, visit CNote’s website.

CDC Small Business Finance, an award-winning community lender, offers several loan options for business owners who want to start or grow their business. As a non-profit organization, our mission is to support those who face the greatest obstacles in securing capital. They include women, minority and veteran-owned businesses in California, Arizona and Nevada.

Tell our loan experts about your business. They’ll work to match you with a financing plan that best suits you. Let’s talk! Reach us at loaninfo@cdcloans.com or (619) 243-8667.

In case you missed it: