Key Takeaways

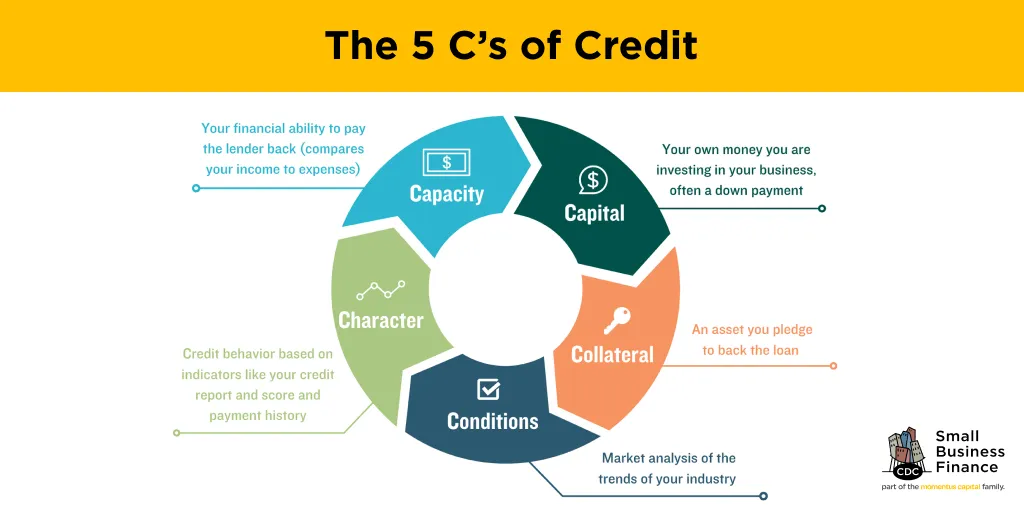

- The 5 C’s of Credit are the five things many business lenders use to determine your creditworthiness as a potential borrower and ultimately whether or not to give you a business loan.

- The first C is Character and is a measure of your creditworthiness based on indicators like your credit score and credit history.

- The second C is Capacity and is a measure of your ability to pay the lender back.

- The third C is Capital and is a measure of how much skin you are willing to put in the game, usually in the form of a down payment.

- The fourth C is Collateral and is a measure of what asset you intend to use to back the loan.

- The fifth C is Conditions and is a market analysis of the trends of your business’ industry

What are the 5 C’s of Credit?

The 5 C’s of Credit are the five criteria many business lenders use to learn about potential borrowers. The 5 C’s help them determine whether or not to give you a business loan.

The 5 C’s of Credit are:

- Character

- Capacity

- Capital

- Collateral

- Conditions

Why are the 5 C’s of Credit important?

Understanding what these five factors are and how the lender will see you on each is vitally important when applying for a business loan, and can make all the difference in getting approved for a loan.

The 5 C’s are a mix of both qualitative and quantitative measures, and once you understand them, you can often work to improve your scores.

That’s why we brought in some of our senior business advisors to help explain what the 5 C’s of Credit are, how to determine where you’ll stack up on each, and give you some practical tips on how to improve your ratings on each to help you get approved for a loan.

Watch Senior Business Advisor, Eddie Landeros, explain the 5 C’s of Credit:

1. The Five C’s of Credit: Character

The first of the five C’s of credit is Character, which is essentially your credit history.

Lenders will typically look at both your personal AND business credit when determining your character, but your personal FICO score is typically the main factor they look at.

This figure is massively important because lenders consider it a reflection of how dependable you are when it comes to repaying debt.

Lenders also generally like to see that your debt-utilization ratio — calculated by dividing your credit card balance by your credit limit — is 30 percent or less.

Lenders view anything more than that as a potential warning sign.

Say you have $10,000 in available credit and you’ve used up $9,000, that’s a 90 percent utilization ratio. If that’s the case, work with a business advisor at SCORE or a local SBDC to review your situation for recommendations on best ways to bring your balance down to 30% or less.

Different lenders typically have different expectations when it comes to your credit score, and different loan products typically require different minimum credit scores as well. It is important to talk to your lender and ask them about their specific requirements.

For example, mission driven lenders like CDC Small Business Finance can offer loans to people with scores as low as 680 (as of August 25th, 2020, check with the loan officer for current eligibility requirements).

Even if your credit isn’t ideal, mission-driven lenders like CDC Small Business Finance may still be able to help. We look at the full picture, and we can also support you with resources to help build or improve your credit.

Pay careful attention to character because lenders will not only analyze your credit report, but also your trends, payment history, and whether or not you’ve paid banks back in the past.

2. The Five C’s of Credit: Capacity

The second of the 5 C’s is capacity, which is a measure of your ability to pay the lender back.

Typically, lenders determine capacity by analyzing both your personal and business income and compare them to your expenses to see if you will have enough money to pay them back regularly.

As the saying goes, cash is king. If you want a loan, you’ll need to show you’re able to generate enough profit to repay it. There are two major ways to demonstrate this.

For existing businesses, it is key for them to have their taxes filed for the previous two years and have their interim financial statements to show income, said Marsel Watts, a CDC senior business advisor.

Additionally, you’ll want to provide historical business performance records and proof that you can support your normal household debt obligations along with the business loan you may get.

Startup businesses will need a complete business plan and realistic financial projections “to help us understand more in-depth the business and their capacity to pay us back,” said Eddie Landeros, also part of the business-advising team at CDC.

Not sure where to start with a business plan? Here is a link to business plan templates to help you. You can also reach out to many free sources to help you develop your plan. Here’s a list of nonprofits offering services to help you get started.

3. The Five C’s of Credit: Capital

The third of the 5 C’s is capital, which is how much of your own capital you’ll be investing in your business.

Bringing some of YOUR money to the table is important. It demonstrates that you are invested in your business and seeing it succeed. A lender wants to see that you have some skin in the game.

Almost every lender assesses capital based on the amount of your down payment. Banks tend to look for a 30% down payment. A nonprofit lender like CDC Small Business Finance is more flexible and requires a 10% down payment for a small business loan and 20% for startups along with industry experience.

Learn more in our understanding down payments video:

4. The Five C’s of Credit: Collateral

The fourth of the 5 C’s of Credit is collateral, which is what you agree to let the lender take if you default on your loan.

Collateral is important to banks because that’s how they secure their loan.

Usually, traditional banks require you to pledge your home or pledge another real estate property that you have like an investment property.

This process is significant for them because in the case someone is not able to pay them back, they can always foreclose on that property and get their money back.

Alternative lenders like CDC Small Business Finance think outside the box by not only accepting real estate as collateral, but also vehicles, boats, yachts, and airplanes (sometimes if they’re small).

5. The Five C’s of Credit: Conditions

The last of the 5 C’s is conditions, which is a market analysis of your industry’s trends at the time you’re attempting to get a small business loan.

For example, if we’re in a recession and there’s not a lot of work for construction companies, some banks will be less likely to lend to construction companies.

Banks tend to have this policy whenever there are problems in a certain industry. For example, if you’re a gym attempting to get a loan in California during a state-mandated closure of all gyms due to COVID-19, it will likely be tough to get a loan from a traditional bank.

Fortunately, alternative lenders like CDC Small Business Finance that are mission-driven are more flexible and look at both the conditions and your whole story when determining approval for a small business loan.

Which of the 5 C’s of Credit is the most important?

All of the 5 C’s are important, but most lenders consider Character to be the most important. Many banks have strict requirements on who they will give certain loans to based on credit score.

Related Articles

Have questions? Here at CDC Small Business Finance, we work alongside our borrowers and support them beyond just getting financing. Contact one of our SBA loan experts in your area to get started today.