How a microloan helped startup keep 100% of their equity — and why that mattered to these entrepreneurs

As consumers increasingly turned to Instagram for the latest retail products and fashion trends, entrepreneurs Ronan Galvin and Casey Mathews immediately spotted a prime business opportunity.

Knowing the average business owner may not have the time or know-how to promote themselves on the platform, they developed a service that would do it for them. Established in 2015, Kickstagram is an automated system that connects small businesses with real Instagram followers in their target demographic to help them increase sales.

As the startup’s client list exploded, Galvin and Mathews knew they needed additional funding to keep up with their growth. After striking out with a traditional bank lender, the San Diego-based duo locked in a $43,200 SBA Microloan through CDC Small Business Finance — a small business lender that has the flexibility to meet smaller firms’ needs.

CDC recently reconnected with Galvin to learn more about him, the roots of his entrepreneurial drive, and Kickstagram’s surging business. We routinely revisit our borrowers to share their amazing stories and tips with other entrepreneurs.

The following Q&A responses were edited for clarity and length.

Q: What ignited the spark in you to become an entrepreneur?

A: I have always been drawn to entrepreneurship. It is really the only thing I am passionate about and always knew I was going to do. In elementary school, I sold baseball cards; and in high school, I ran a casino out of my garage.

The Kickstagram team.

Q: What has been your most satisfying moment in business?

A: Creating jobs for other people.

Q: What were some critical points you faced while starting and growing your business?

A: Our business is entirely bootstrapped so starting out it was really hard financially. We know we could have grown faster if we had more money. But at the same time, growing slowly has allowed us to see what is and isn’t working in our business and adjust accordingly. Another critical point was/is learning how to manage people. Being young and hiring young people who are around the same age it is a little tough not to blur the line between employer and peer. No better way to learn then by doing though.

Q: What was the reason behind needing financing and how has it helped your business?

A: Getting a loan from CDC allowed us to hire more employees while retaining 100 percent equity in our business.

Q: How many more people did you hire?

A: We doubled in size! We went from 5 to 10 employees.

Q: Why was it important for you to maintain 100 percent equity in the business?

A: If we had the opportunity not to give up equity then would we take it? Of course. When you start a business initially you’re thinking, “Go out and raise funding and give up half of the company” because it’s easier. We took a different route. The money we make we put back in the company.

Q: Did you try other means of financing before coming to CDC?

A: We tried (Bank of America) first but did not meet their minimum funding requirements. We didn’t or haven’t looked for (venture capital) funding as we want to keep as much equity as possible for as long as we can.

Q: What most appeals to you about being an entrepreneur?

A: The creativity and the problem solving every day. And figuring out how to: form a team, build a culture, improve sales and take in customer feedback. When you’re building a business, you’re really trying to solve a big problem or a combination of small problems.

Q: What would you consider the Top 3 skills needed to be an entrepreneur?

A: Flexibility, persistence, creativity. Flexibility because things will never go as planned. Persistence because there are going to be a million times you want to quit or throw in the towel, but as long as you keep going things will work out. And creativity because if you are going to start your own venture you need to have great ideas to stand out from the competition.

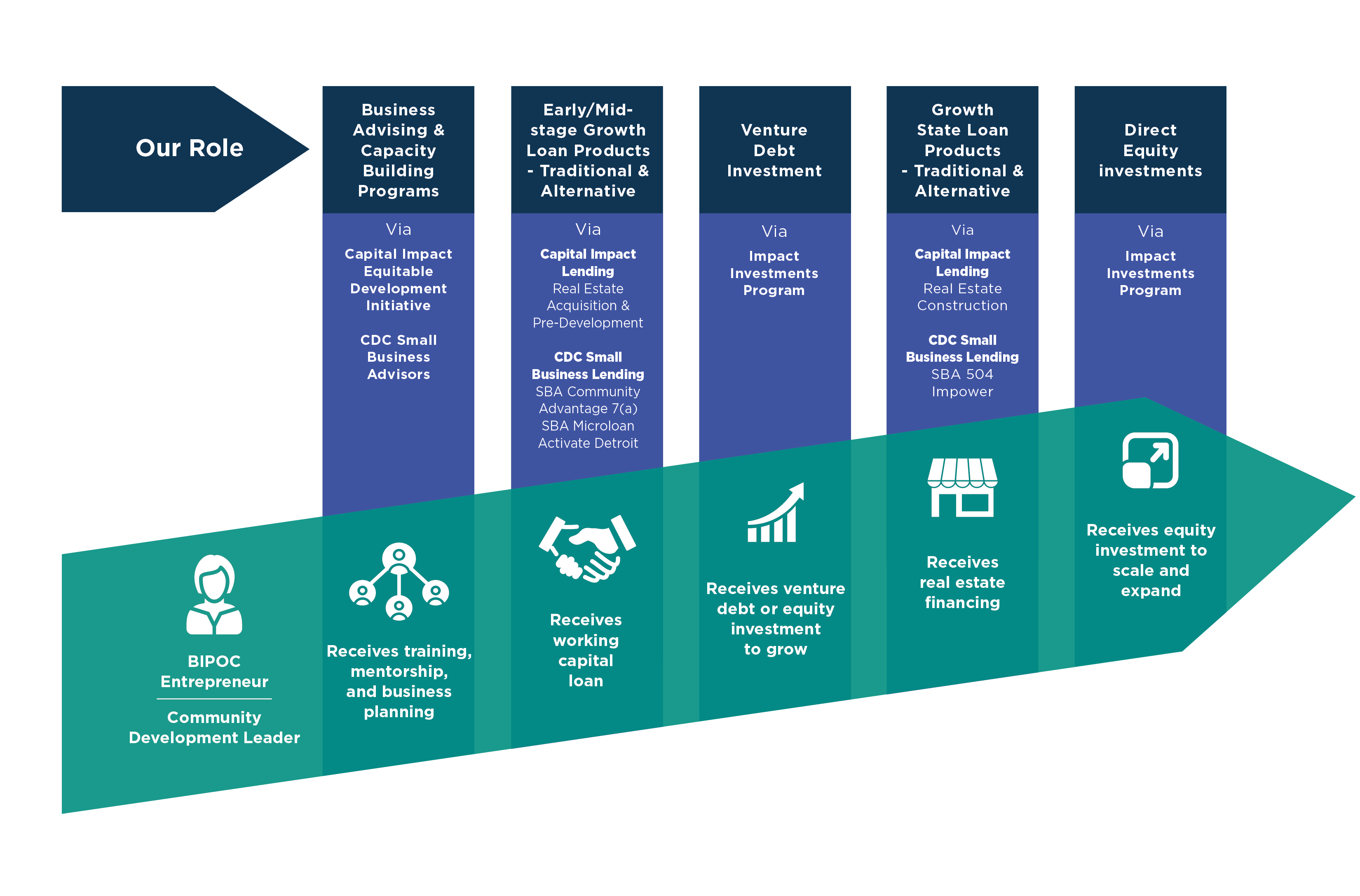

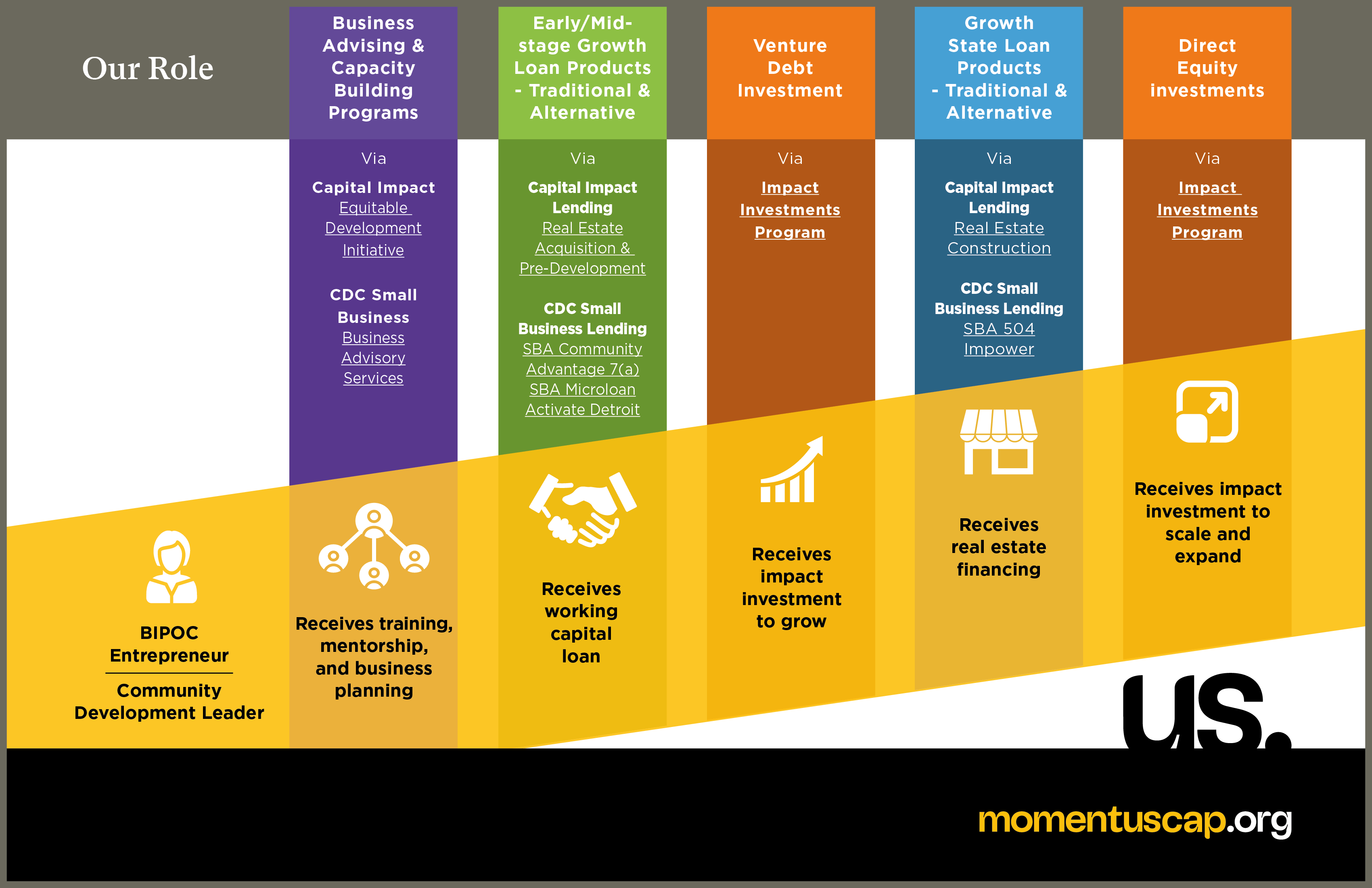

Are you a startup owner in need of financing? The microloan program offers loans up to $50,000 for expansion or start-up costs. This is a great option for borrowers experiencing trouble getting credit through a traditional bank but can demonstrate strengths and show the capacity to repay the loan.

Tell our loan experts about your business, and they’ll work to match you with a financing plan that best suits you.