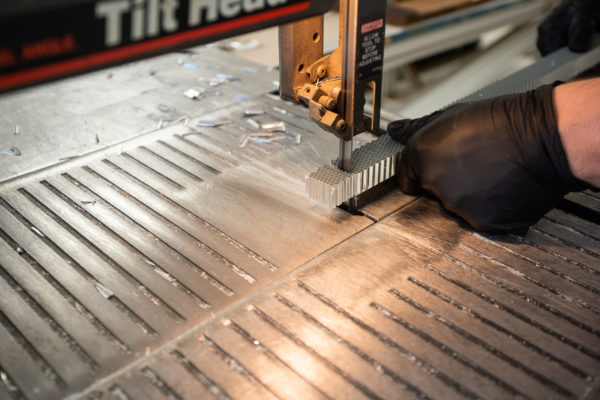

U.S. Air Force veteran Kevin Darroch’s business involves fabricating crucial parts the typical layperson often takes for granted. We’re talking about the lightweight yet ultra-sturdy cores of what will become heat shields for space rockets, wings for Boeing jet airliners, and other components ubiquitous in the aerospace field.

How we helped

- Provided SBA 504 loan to buy building to house company, equipment and operations.

- SBA 504 loan provides low rate, long-term security and stability.

- Helped borrower use tenant improvements as a down payment. That meant no money out pocket for closing.

- Allowed company to preserve the cash to invest in the business.

Carlsbad, Calif.-based MachineTek – which precision-cuts, shapes, heat-forms and stabilizes a material called honeycomb – is one of 2.5 million veteran-owned businesses in the nation. Here’s another way to imagine the jaw-dropping impact of military vets: These firms are responsible for generating 5 million U.S. jobs and $1 trillion in sales a year. MachineTek alone employs 45 employees and has a hand in millions of dollars of aerospace parts a year.

“When you hear ‘veteran-owned business’ you can bet it’s a well-run business operating with integrity,” said Darroch, a service-disabled veteran who’s helmed MachineTek for more than two decades.

Known for its in-house engineering expertise and personalized customer service, MachineTek has been on a trajectory of growth since it was founded. Increased demand from the major aerospace players, from SpaceX to Boeing, motivated Darroch about five years ago to focus on securing his business’ long-term future.

He accomplished that by buying a building with an SBA 504 real estate loan through CDC Small Business Finance, a leading small business lender that steps up for the underserved, including women, minorities and military veterans.

Our team recently revisited Darroch and his business to check on their progress since obtaining this fixed-rate real estate financing.

Military service informs founding of veteran-owned business

After graduating from the University of Southern California in 1979, Darroch served in the U.S. Air Force as a fighter pilot and later in the reserve. He retired from the service as a lieutenant colonel in 2003.

Serving his country primed him for business ownership. The U.S. military, he said, is a no-nonsense organization that assigns you great responsibility at a young age and expects back from you a job well done.

“It allowed me to develop leadership and organizational skills to form and manage my own company,” he said.

In the late 1980s, he bought a business in Santee that specialized in aerospace machinery. And a small portion of that company involved honeycomb fabrication. The business eventually shuttered, mainly due to the departure of General Dynamics from San Diego County and the onset of a recession, he said.

The bright side here: Darroch saw opportunity in honeycomb fabrication, which then was an underrepresented niche.

What is honeycomb? It’s a material that comprises the core of composite panels used in planes, spacecraft and other products. Think of a typical airplane wing. Using the sandwich analogy, the honeycomb is essentially the “meat” of the wing and the skins serve as the “bread.”

From a birds’ eye view, this material looks like actual honeycomb, the hexagonal-shaped waxy plate built by bees. Holding the manufactured version, you’ll notice it’s lightweight yet extremely durable, given the important roles it plays in the sky and in space.

This, Darroch determined, would be the future of MachineTek, which he launched in 1992. To be clear, the company doesn’t produce the raw materials that become the fabricated honeycomb components; that material comes from outside vendors. MachineTek’s job is to precision-cut, shape and heat-form the material to the customer’s specifications, preparing the part for the next stage of production.

Securing commercial real estate for long-term goals

Fast forward two decades later to 2013, MachineTek is employing a dozen employees and is only one of six manufacturers in this specific niche nationwide.

By this time, he’s cultivated relationships with companies such as Goodrich to fabricate honeycomb cells for its Boeing 737 and 767 programs.

Also, at this point, Darroch had been leasing his Carlsbad, Calif. company building for about five years and has infused more than $1 million in tenant improvements into the space. The 21,000-square-foot commercial building houses MachineTek’s manufacturing operations and several pieces of expensive heavy machinery.

It was at this point MachineTek learned the building owner was considering placing the property on the market. He settled on the strategic move of trying to purchase the space they were occupying.

If at any point Darroch was forced to move, he realized, he’d be in dire straits — experiencing the high expense of moving the heavy machinery and losing the sunk cost of the tenant improvements.

“The cost of relocating a company of this size wouldn’t be cheap,” he said.

Darroch worked with Merri Adams, a senior commercial loan officer with CDC Small Business Finance, to obtain an SBA 504 real estate loan. This type of financing offers a low, fixed interest rate and only a 10 percent down payment from the borrower.

Adams and her team worked diligently to structure the deal to increase the chances of approval and funding. Not only was the loan approved, Darroch paid nothing out of pocket since past tenant improvements were counted as the required down payment from the borrower.

“I owe it all to you, Merri,” Darroch said in a recent reunion with Adams at Machintek’s headquarters. “It worked out very well for us…the building is well-suited for our specialized requirements and we are spared the cost and disruption of relocation.”

Post-business loan funding: Where is MachineTek now?

If your landlord were to terminate your lease, would that jeopardize your business?

That is a key question all businesses should ask themselves, Adams said. And if the answer is yes, then you should seriously consider buying your own building to secure long-term security.

“If a landlord had placed the building on the market, Kevin’s business could have been in trouble,” she added.

It’s been four years since Darroch received the SBA 504 funding through CDC Small Business Finance. MachineTek has since experienced significant growth.

He’s increased his workforce from 12 to 45 and is continuing to hire “left and right,” he said. His book of business has also diversified. Roughly half of his clients are in the space industry, from Space X to Virgin Galactic.

The ramped-up demand for honeycomb fabrication has also meant the business has grown into the 21,000-square-foot building, which includes a mezzanine area formerly configured as a large office area.

“When you own your building, you secure your future,” Darroch said. “With fixed facility costs and guaranteed continued occupancy, building ownership allows for long-range budgeting and planning. And, of course, there is the potential for capital appreciation. Buying this building was the best decision we’ve ever made.”

Jobs created/preserved: 45

CDC Small Business Finance offers several loan options for business owners who want to grow their operations and are planning for their long-term needs. Tell our loan experts about your operations, and they’ll work to match you with a financing plan that best suits you.