This blog post on the importance of financial forecasts was originally published on Bplans.com, a service that helps entrepreneurs create effective business plans and fundraising pitches that appeal to investors and bankers. CDC Small Business Finance proudly offers the company’s LivePlan tool to our borrower clients.

Business owners and managers create financial forecasts to enhance management. Anticipate essential flows of money to manage them better. Forecasting is a necessary first step toward managing plan vs. actual results, which means course corrections. It’s like steering a business.

You can’t identify changes in flow if you don’t have financial forecasts to refer back to as you review and revise according to changes.

Real management is a matter of minding the details while working towards the right long-term directions. Step by step. Forecasting is part of the management process. When sales are different from planned, you look at the connected spending, and adjust. Change the resource allocation when things are going well or poorly. Identify problems with execution and opportunities that result from the unexpected.

Also from BPlan: Books Every Entrepreneur Should Read in 2018

You should note also that the value of financial forecasts isn’t a matter of accurately predicting the future. We’re human. We don’t do that well. Instead, it’s a matter of identifying the connections between sales and spending, and managing the ongoing interaction involved.

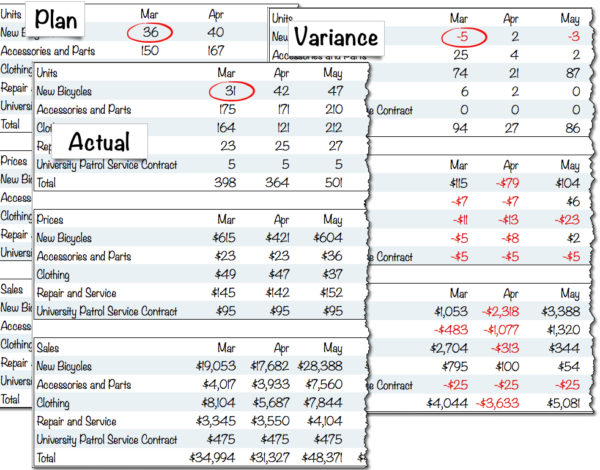

In the example above, bike-unit sales were less than planned, but the dollar sales were higher. Is that good news or bad? It’s not necessarily either one, right? And it is also quite possibly highlighting a market trend that management should be aware of.

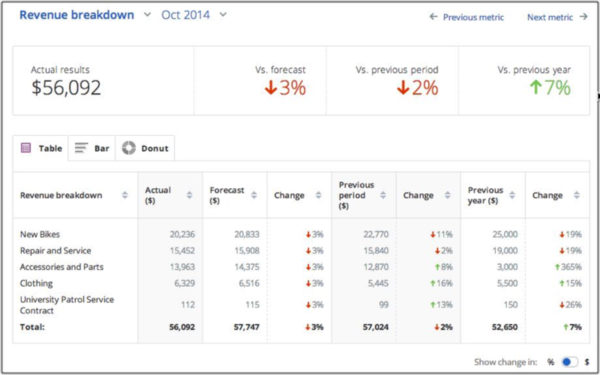

A LivePlan Example

Another example, from LivePlan: Monthly sales are below the plan but above the previous year. Accessories and clothing are better than the previous year, but bicycles sales are below the previous year. Is that a trend to manage? The numbers don’t say, but the people should know. The numbers are there to begin the discussion.

In case you missed it: