Top 11 Ways You Can Use Your Small Business Loan

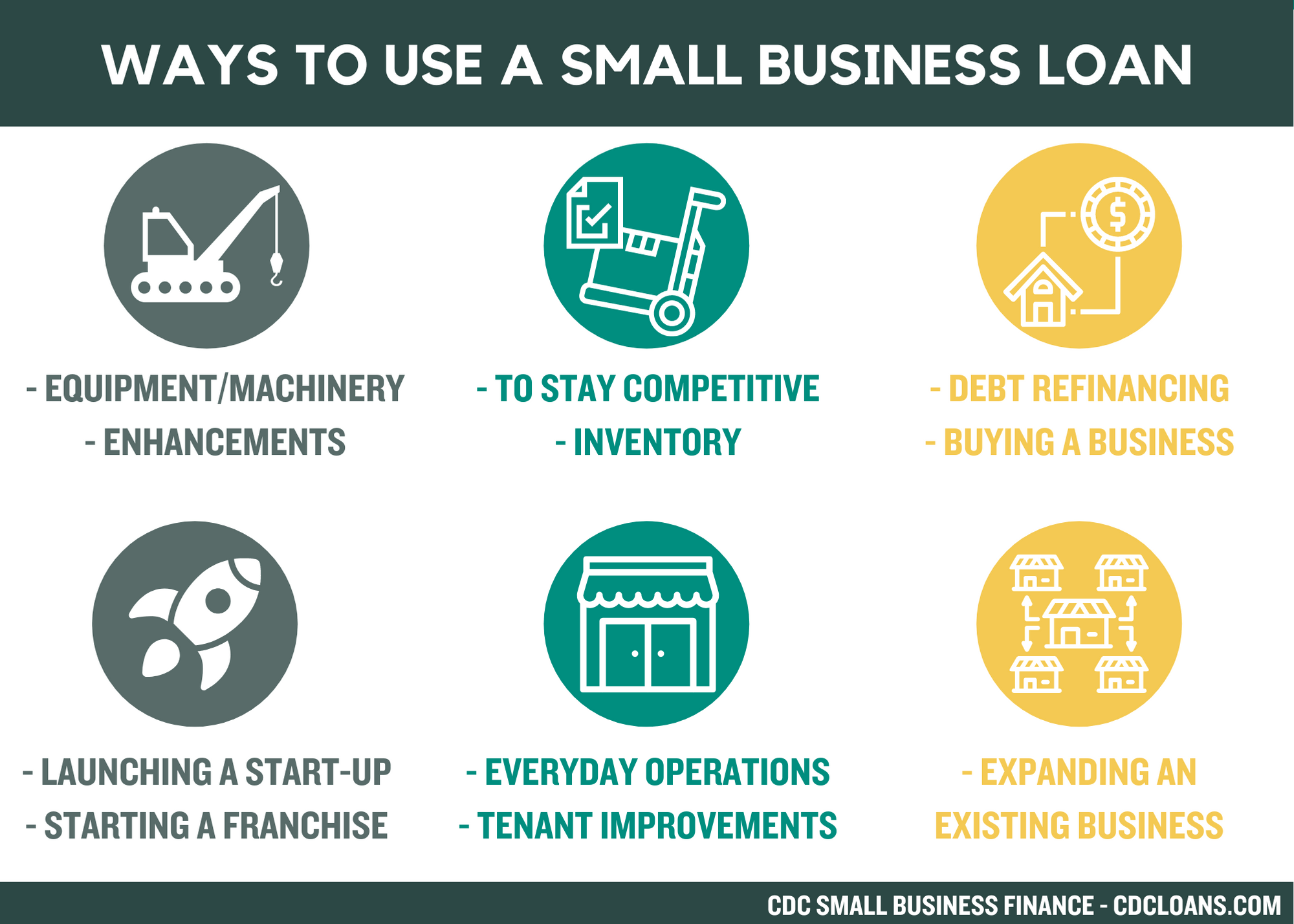

When you’re a small business owner, getting from Point A to Point B in your entrepreneurial pursuits may require some outside financial help. Whether you need additional funds to cover day-to-day costs, an equipment purchase, or the build-out of your new space — a small business loan can help you achieve your specific goals.

Before you start the process of obtaining a working capital small business loan, it’s important to identify how you are going to use the financing. Knowing exactly where you plan to use the working capital can help you create a strategic plan for your business and target how you will pay back the small business loan.

What Are the Top Uses for a Small Business Loan?

Small Business Loan Uses: Within your Business

There are multiple costs associated with running your busy every day. From payroll to rent to marketing, the cost of daily operations can add up.

A working capital or small business loan helps make cash available for business owners to better manage their expenses and any business fluctuations.. Such financing can be a great tool for companies that experience extreme changes in business due to seasonality. Small business loans in that instance can help entrepreneurs get through off-peak seasons.

2) Equipment/machinery

Whether you’re a restaurant owner or a healthcare provider, you rely heavily on equipment in the day-to-day flow of your business. One way to use your general business loan is to fund the purchase of equipment. Whether you need it to scale up operations or a piece of machinery is on its last legs, a general business loan can help you purchase the needed equipment or machinery.

3) Tenant improvements

As a business owner, if you’re moving into a commercial space that’s essentially a shell — you’ll most likely be responsible for paying for all or part of the buildout. This is also known as tenant improvements or TIs.

TIs can include installing a new kitchen for a restaurant or offices for a law firm. The landlord may give the renter — the small business owner — an allowance to pay for all or some of the tenant improvements. But anything above that amount is paid for by the renter. This is where a small business loan can be used to finance any remaining project costs.

4) Inventory

Certain businesses such as retailers or specialty food stores rely on the sales of their inventory to generate income. Inventory can range from the latest fashion must-haves to butter and eggs for cupcakes. In this case, a small business loan can be used to help small business owners buy inventory in bulk to properly stock their shelves and potentially take advantage of discount pricing for orders of a certain size.

5) Debt refinance

With the rise of lenders who deal only in the online space, small business owners can often find themselves in a costly situation.

Many of these types of loans can lead to paying annual rates of up to 50% to 150% over the life of the loan. Compare those rates to those from community lenders such as CDC Small Business Finance, which are known for being affordable and responsible.

In recent years, those who’ve taken out higher-interest online loans have come to CDC Small Business Finance to get out of their cumbersome loan payments. Due to our flexibility, we’ve been able to refinance dozens of online-only business loans to more affordable general business loans, helping clients save hundreds even thousands of dollars each month. With those savings, these small business owners are now able to focus on growing their business.

Small Business Loan Uses: General

If you are looking to start, buy, or expand, working with a community lender like CDC Small Business Finance to get an SBA (Small Business Administration) small business loan can be a great option. To get financing the lender looks for you to have experience in your industry, ability to contribute a down payment, a business plan and more.

6. Acquiring a business

If you are looking into buying a business, a small business loan may be the tool that will help you pursue your dream. It’s important to work with a trusted lender who can help you identify an affordable loan that will support your long term goals.

7. Starting a franchise

Buying and operating a franchise often lands in between bootstrapped entrepreneurship and traditional employment. If you are an aspiring franchisee, you can use a small business loan to get your business off the ground and running. Being a franchise owner means you will have the franchisor’s resources, business model, and stability while enjoying small business ownership. You can use a working capital loan for almost anything you need to get your franchise going.

8. Use a small business loan for start-up costs

Launching a start-up means you have different needs than most traditional businesses. You can use a small business loan to help cover employees, technology, and advertising expenses. A small business loan can also help in areas like sales and marketing, contingency planning, human resources, and scaling up.

CDC has been a fantastic partner. The entire team was so responsive and helpful.

Mark Tran, Somisomi

9. Expanding an existing business

If your small business has successfully maneuvered those challenging early years, you may be thinking, “what’s next?” If your business is experiencing growth and there is a need for additional staff or plans to construct a brick and mortar, obtaining a small business loan may be the solution. If you are going to use a small business loan to expand your business it’s important to review your past few quarters and make projections for the next few years while playing out various scenarios.

10. Staying competitive

If you are a long-standing small business that is looking to stay competitive in your industry you can use a small business loan to keep you up to speed. Small business loans can be used for new computers or technology updates. You can also get financing for leasehold improvements, commercial vehicle repairs, or updates on operating equipment. Use a small business loan to keep your business competitive in the 21st century.

11. Enhancements

You can use a working capital loan to buy fixtures for such as built-ins, lighting, and plumbing. The loan can also be used to improve landscaping or redo your parking lot.

What type of small business loans should I consider?

A community lender such as CDC Small Business Finance typically provides two types of affordable, working capital small business loans: SBA and non-SBA.

- SBA loans are backed by the federal government, specifically the U.S. Small Business Administration. Organizations such as CDC Small Business Finance are certified by the SBA to provide SBA loans to small business owners. Thanks to the SBA’s backing, community lenders can finance businesses that most conventional lenders would consider a bit riskier due to credit blemishes or the fact they’re a startup. Here are two of the main working capital small busienss SBA loan programs:

-

- SBA Community Advantage: Loans up to $250,000. The loan funds new or existing businesses. You can also use it to acquire a business.

- SBA Microloan: Provides loans up to $50,000 to help small businesses start up and grow. This program is perfect for small business owners seeking a smaller loan.

- Non-SBA options. Community lenders such as CDC Small Business Finance may also have non-SBA loan options so that they can meet your needs if an SBA loan is not a match.

How can I qualify for a small business loan?

Regardless of how you use a general small business loan, you must meet the eligibility requirements of the lender you’re working with.

A community, mission-driven lender generally has less stringent eligibility requirements compared to a conventional bank. Also before approaching a lender, be sure to calculate how much financing you need and for what purpose. Having a plan will let your lender know you are serious and ready for your financing.