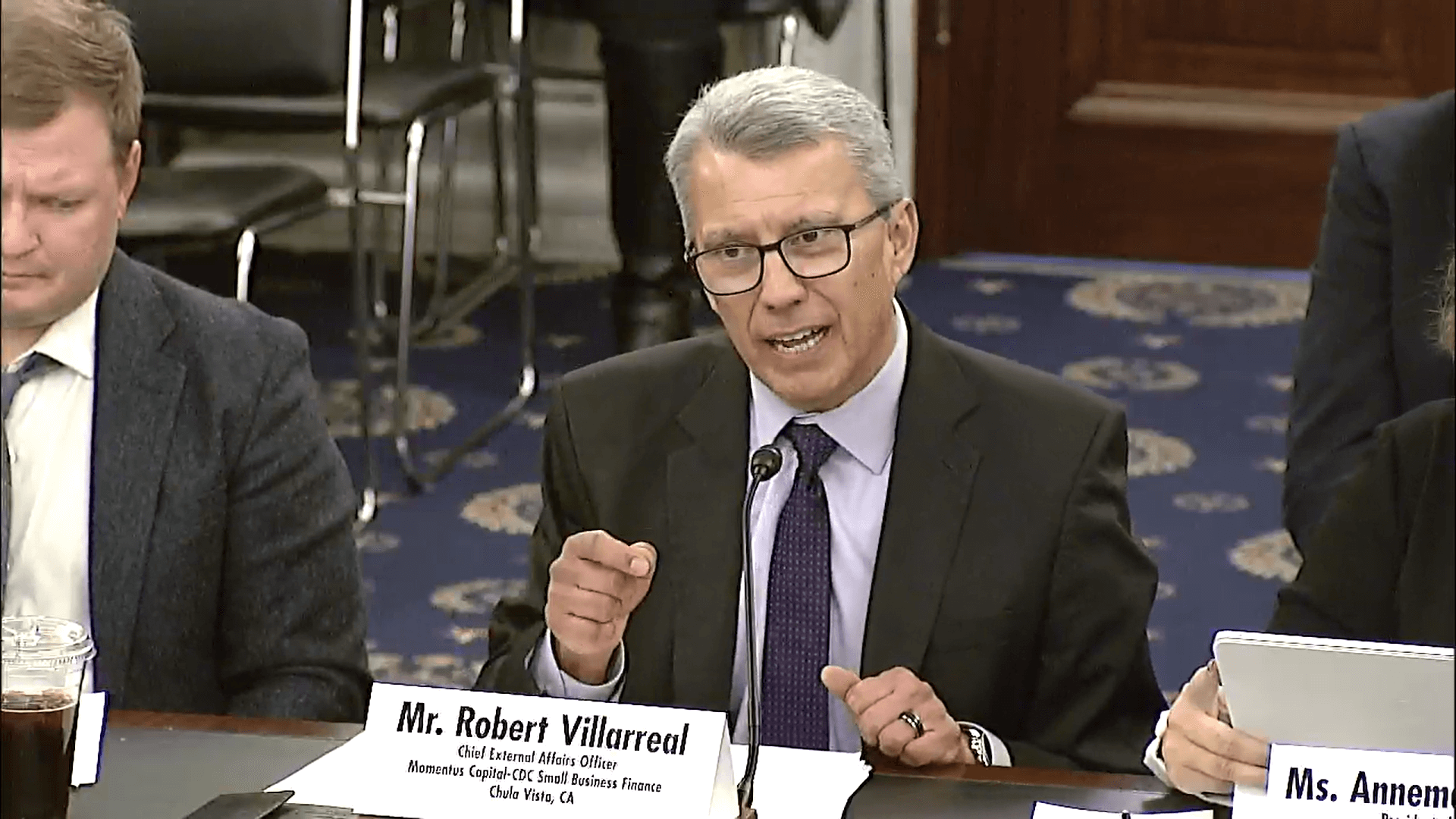

Momentus Capital’s Chief of External Affairs, Robert Villarreal, recently testified in front of the Senate Committee on Small Business and Entrepreneurship about improving access to capital in developing communities through the Small Business Administration (SBA) 7(a) Community Advantage (CA) loan program.

The Community Advantage pilot program was launched in 2011 to expand the points of access that small business owners had for getting loans from mission-driven financial institutions. These lenders intentionally support emerging community members, businesses, and organizations — with an emphasis on assisting growth-ready businesses and startups.

From September 2021 to October 2022, CDC Small Business Finance, a part of the Momentus Capital family of organizations, approved $37,561,700 in Community Advantage loans, far surpassing all other lenders nationwide. During this time, we approved 253 SBA 7(a) Community Advantage loans, averaging more than $148,000 per loan. Last year, CDC Small Business Finance was also named the top Community Advantage lender in the country.

Following this success, Robert’s impetus for testifying before the Senate Committee is to make the SBA 7(a) Community Advantage Loan Program permanent. And doing so would secure ongoing federal funding to expand community entrepreneurship in the US, among many other positive implications.

Download Robert’s testimony to learn the benefits of making the Community Advantage loan program permanent.