“We have grown geographically, loan volume, employees, and most importantly, we have grown in impact . ”

Hear from Kurt Chilcott, President + CEO, CDC Small Business Finance

#1 SBA 504 LENDER

#1 SBA COMMUNITY ADVANTAGE LENDER

DIRECT BUSINESS LENDING

Achieving the ‘American Dream’

While some people are fine coasting through life, others like Mia Davis only want to summit mightier mountains. Her last two-plus decades have encompassed immigrating to the U.S. from Guam, launching a new career while moonlighting as a restauranteur.

Upon learning a landmark sushi joint in Carlsbad, Calif. was set to close, she saw opportunity written all over this development. She’d go on to buy the business, Mikko Sushi, then freshen up the menu and branding. When she was ready to launch the second location of Mikko Sushi, in nearby Vista, Calif., her entrepreneurial instincts told her buy, not lease, a space for the new site.

CDC Small Business Finance provided her a $1.4 million SBA 504 loan to finance a 3,800-square-foot building to house this location. With this loan, Davis not only enjoys a low, fixed rate, she also came away knowing she is investing in her business’ future while building personal wealth. More of Mia’s story

“I believe in the American Dream, to me, this is the American Dream.”

Mia Davis

The SBA recognized CDC Small Business Finance as a lender that has gone above and beyond in helping the small business community.

$401.2M

Approved for small businesses

519

Entrepreneurs financed

$146.5M

Approved for women, veterans and minorities

8,344

Jobs created and preserved

7,500

Business advisory hours provided at no cost

Robert Villarreal, EVP, Economic Development + Allison Kelly, SVP, Strategic Initiatives

460%

Increase in impact to

Diverse Small Business Owners

With the help of strong allies, we can certainly achieve both. Maintaining these complementary goals is more important than ever as small business owners continue to face the pressing challenge of access to affordable and responsible financing to launch and grow their businesses. In turn, these loans support the growth and success of the communities in which these businesses are based. Want to make an impact? Connect with Robert Villarreal.

Finding a way to finance bullet train-like momentum

What started as an a-ha moment involving so-called “healthy” diet choices has evolved in a successful natural frozen-food line that’s caught the attention of nationwide retailers.

Behind the wheel of this growing empire is Angela Bicos Mavridis. The former retail-shop owner turned holistic nutritionist says many of the protein bars and shakes she consumed were making her feel sick. This motivated her to launch Tribalí Foods — a meat product line that offers the convenience of frozen meals without the artificial ingredients you may find in other brands — all inspired by her Greek heritage.

To maintain her company’s bullet train-like momentum, she came to CDC Small Business Finance for an SBA Microloan, financing designed to help young companies get off the ground. Mavridis used the funds to keep the production pace strong and to buy raw materials. It also helped her focus on getting her product into more retail giants including Whole Foods, Target and Bristol Farms.

“We had great momentum, brand recognition and growth, we just needed a way to finance that growth,” she said. More on Tribali Foods

“The SBA and CDC were very easy to deal with. I had lots of confidence in the CDC soon after I met some of the representatives and didn’t feel the need to look elsewhere.”

Angela Bicos Mavridis

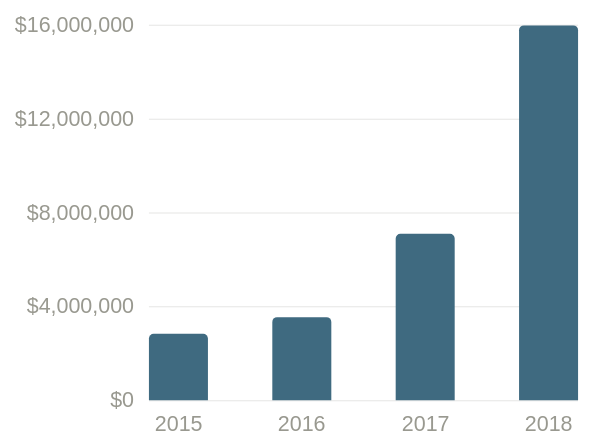

880%

Year-over-year growth capital raised

from investor network

Capital Partners

Prudential – $15M • CNote – $5M • Manufacturers Bank – $2M

US Bank – $1M • City of San Diego – $1M

Citizens Business Bank – $500k

Grant Partners (>$25k)

Bank Of America • City of San Diego • Heron Foundation

JPMorgan Chase • Pacific Premier • SBA Microloan

Union Bank (MUFG) • US Bank • Wells Fargo Bank

$688M

Total SBA 504 project (Business owner + CDC + Bank)

Building Ownership’s Ripple Effects

We’ve long believed in the far-reaching, transformative power of owning commercial real estate especially in communities that need the most support. Ownership allows entrepreneurs to take control of their own financial destiny. Business owners that purchase their building begin creating wealth for generations, not just household income but household wealth. Each and every SBA 504 loan project can have a profound rippling effect on our communities by generating more jobs, spurring improvement projects and ultimately elevating neighborhoods.

Thank you to our Borrowers, Partners, Community and the heart of CDC, our Board and Staff, for helping us make a difference.

40-Year Impact by the Numbers

$18.4B financed • $96.8M approved for SBA Community Advantage

$9M in SBA Microloan financing • 203,000+ jobs created/preserved

Over 11,000 businesses funded

We’d like to send our deepest, sincerest thanks to everyone who played a part in helping entrepreneurs in 2018. Our appreciation in particular extends to our many partners and clients.