CDC Small Business Finance has always evolved its services and offerings in order to best serve both small business owners and their communities.

As we looked to the future, we saw a tremendous opportunity to do more, give more and make a bigger difference. With that in mind, more than a year ago, we began conversations with Capital Impact Partners. Together, we recognized how our similar visions and complementary expertise, services and financing products could create a change that neither of us could accomplish independently.

So, today, we are excited to announce:

A new alliance between CDC Small Business Finance and Capital Impact Partners

Read the press release

This new alliance brings:

A Bold, Holistic Approach to Drive Change

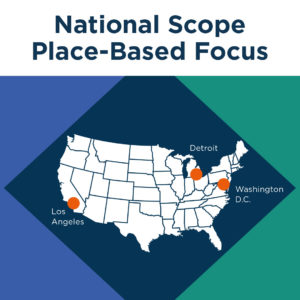

With a mission to empower equitable community growth, CDC Small Business Finance and Capital Impact Partners are initially collaborating on launching three place-based pilot programs. The pilots will launch in Los Angeles, Detroit, and Washington, D.C. Metropolitan (D.M.V) Areas.

Cross-organizational teams will actively engage with the communities to identify the problems unique to each city. The pilot programs will be customized to holistically address the recovery and relief needs of community members, small businesses, and organizations that have been devastated by these uncertain times.

The locations of the three pilots were intentionally chosen based on the current geographic focus of both organizations and the need for empowerment strategies in the communities.

Lessons learned through the initial pilots will inform future efforts to define new approaches to economic and community development to transform the industry and create change.

Scalable Solutions

With a shared focus on economic empowerment and equitable wealth creation, CDC Small Business Finance and Capital Impact have the unique ability to deliver a suite of lending products and programs that holistically support communities to be strong, vibrant, and healthy places of opportunity.

The combined knowledge and expertise, unique to each organization, will foster an acceleration of the work necessary to solve for critical needs at scale.

SBA 504 lending in California, Arizona and Nevada, is our flagship program and we will continue to be a leader in delivering much needed commercial real estate financing to those small business communities. Our work with Capital Impact Partners will also explore opportunities to extend CDC Small Business Finance’s commercial real estate expertise to a broader platform beyond the SBA lending space.

In addition, our expertise in lending working capital will be leveraged in each of our place-based pilot-programs. Our work will improve access to small business capital, especially for Black and Latinx entrepreneurs, which is critical for economic empowerment and ultimately driving generational wealth creation.

Capital Impact’s core work supports equitable access to critical social services through leadership in mission-driven lending and innovative program development that provides technical assistance and capacity building for community-centered work. Their work as a partner and lender helps communities drive solutions that break down barriers to success and creates transformation.

As we reach to make a greater impact than we could individually, our combined core strengths will guide us in creating a new approach that can be replicated to best serve the needs of communities.

Commitment to Change

Both organizations are driven by their passion to be part of a solution to address the widening racial wealth gap by improving communities’ access to capital. Discussions about how to make a bigger impact began a year ago, however, today the need is greater than ever. Generations of inequality have been brought to the forefront. The long-standing issues that both organizations have been agents of change for are especially magnified by the disproportionate impacts of COVID-19 on Black and Latinx communities as well as the issues raised through the current racial justice groundswell.

With a laser focus on these systemic issues and a more than 40-year commitment to change, CDC Small Business Finance and Capital Impact Partners are well positioned to bring new programs and resources that can address these challenges.

A Partner to Communities, Funders and Investors

The heart of both organizations has always been founded in partnerships and collaboration.

Through the alliance, both organizations will continue to partner with states, cities and communities to further racial and economic justice. Together we will be able to provide whole-person strategies to influence transformative community change.

The organizations have also identified the strong need in the marketplace for a conduit for funders and investors to effectively connect capital to communities. By aligning, the organizations will work to be that partner to banks, funders and large institutions in an effort to help them overcome legacy challenges of deploying funds for community impact.

Capital Impact Partners

If you are not familiar with Capital Impact Partners, you can learn more here.

Capital Impact Partners is among the top Community Development Financial Institutions (CDFIs) in the country. They have disbursed more than $2.5 billion since 1982 to ensure equitable access to quality health care and education, healthy foods, affordable housing, and the ability to age with dignity. Through capital and commitment they help people build communities of opportunity that break barriers to success. They have a 35-year history delivering strategic financing, social innovation programs, and capacity building that creates social change and delivers financial impact nationwide.

We are honored to work alongside Capital Impact Partners

We are excited to bring more resources and solutions to our borrowers, the small business community and our referral and community partners through our new alliance. We all share a common goal to create impact and make a difference. We are excited to create this new path forward and bring holistic change and transformation to the industry, small business owners and communities.

Learn more

Want more details about our new alliance? Read the full press release here.