Why rent when you can own?

You can use an SBA 504 loan to buy, construct or improve commercial real estate or to purchase heavy equipment. Talk to one of our SBA 504 loan experts to learn how you can take advantage of a long-term, fixed rate and low down-payment (only 10%) SBA commercial real estate loan. Many of our borrowers find that their loan payment ends up being less than what they were paying in rent.

See below for details on rates, loan amount, eligibility, loan structure, key benefits and more.

See the top questions we hear from small business owners who are considering buying a commercial building. Get answers on timing, fees and loan size.

"If you can get into a 504 and buy your building … now you’re investing in your own asset."

Chris Kuran, President, Waterstone Faucets

Preserve cash – down-payment is only 10%

Below-market fixed interest rate

25, 20 or 10 year term options

Build owner equity

Tax savings

No additional collateral needed

Only 51% occupancy required

Fixed occupancy costs

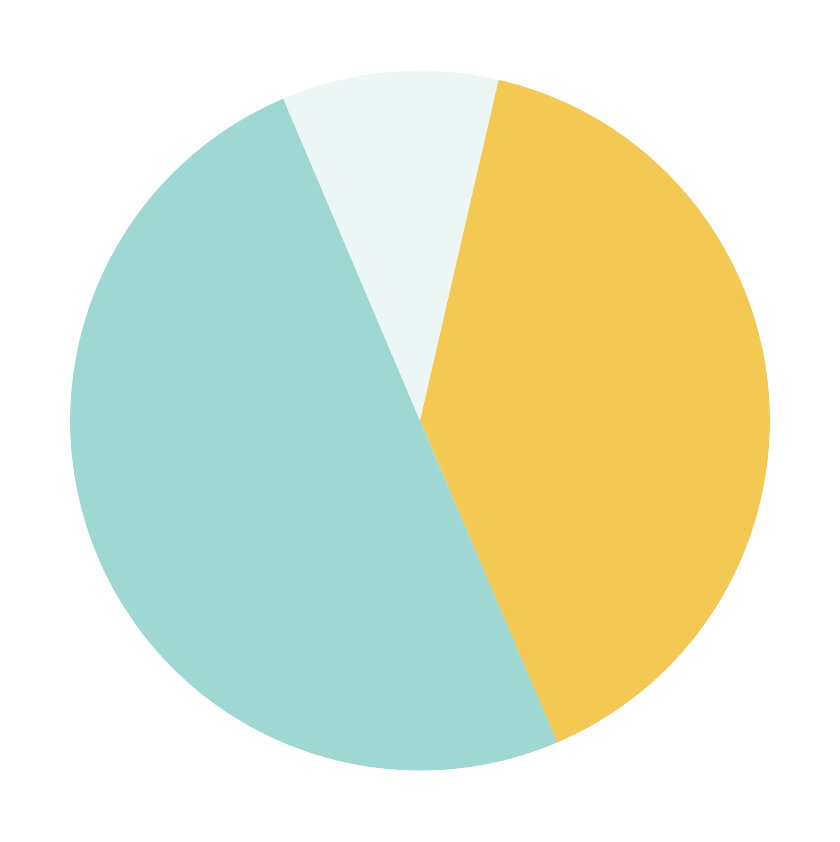

CDC / SBA (40%)

Bank (50%)

Business Owner (10%)

Count on knowing your occupancy costs with a below-market fixed rate.

Get equity, tax and cash flow advantages by owning your heavy equipment.

At least 51% Owner Occupied

For profit

A sole proprietorship, corporation, partnership or LLC

Business net-worth below $20 million and a net-profit after taxes below $5 million with the last two operating years

Business is located in our lending footprint: California, Arizona or Nevada

Straight purchases usually require no more than 60 days to fund. If construction is involved, this can extend the process.

All the fees are financed into the loan; consisting of 2.625% of the loan amount plus legal fees of $2,500.

Yes, “soft costs” (e.g. appraisals, environmental, construction interest, closing costs) can also be financed in the 504 loan, allowing the small business to preserve working capital.

The business must occupy 51% of an existing building purchase or 60% if constructing a new facility.

Long-term machinery and equipment with a useful life greater than ten years (e.g., a printing press).

We understand that not all of our borrowers are able to qualify for the SBA 504 loan product due to its eligibility requirements. To bridge that gap, we’ve created the new Impower loan. Learn more here

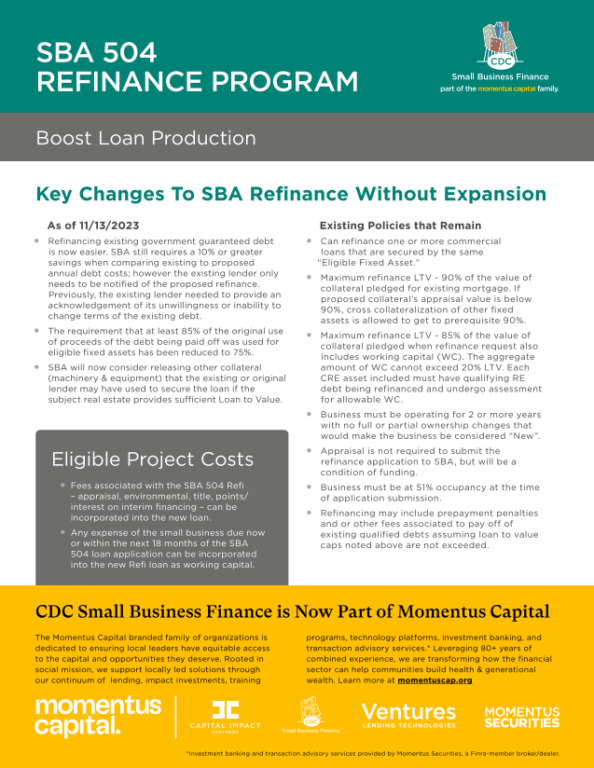

SBA 504 Refinance Program

Refinance Non-SBA guaranteed commercial real estate loans into a more affordable SBA 504 loan

Learn more about the program:

The SBA 504 Green Loan offers up to $5.5 million in financing per project from the SBA. Small businesses can secure multiple SBA 504 Green Loans, each with the maximum of $5.5 million and an aggregate not to exceed $16.5 million from SBA financing. Individual projects can be greater than $16.5 million but keep in mind the combined cap for SBA Green lending.

"When I tell people how I bought a building and was got a loan they are surprised. For me, it is the American dream."

Mia Davis, Mikko Sushi

"As an immigrant, we came here with very little and we got the opportunity to work hard and open our own business. Now I look back and I am very happy and very thankful for being in this country."

Duke Huynh, Owner, Phở Ca Dao

"We decided to move forward with the SBA loan and to this day it's been a great success as we were able to expand our operations, hire new people, and get us ready for the future."

Jesus Ramirez, JXR Constructors