Banner Year for Smaller-Dollar Loans

A U.S. small business loan program that directs help to underserved communities — including women, minorities and veterans — recorded a banner year in 2017, according to recent data from the U.S. Small Business Administration.

The news comes as national economic indicators continue to trend upward. Stocks are on the rise, the economy is growing at a faster-than-expected pace, and consumer spending saw its biggest jump since 2009.

Dubbed the SBA Community Advantage Loan Program, the initiative issued more than $138 million in financial backing to small business owners in fiscal 2017. That’s an 11 percent increase from last fiscal year. Lenders logged a total of 1,043 loans, a 6 percent year-over-year bump.

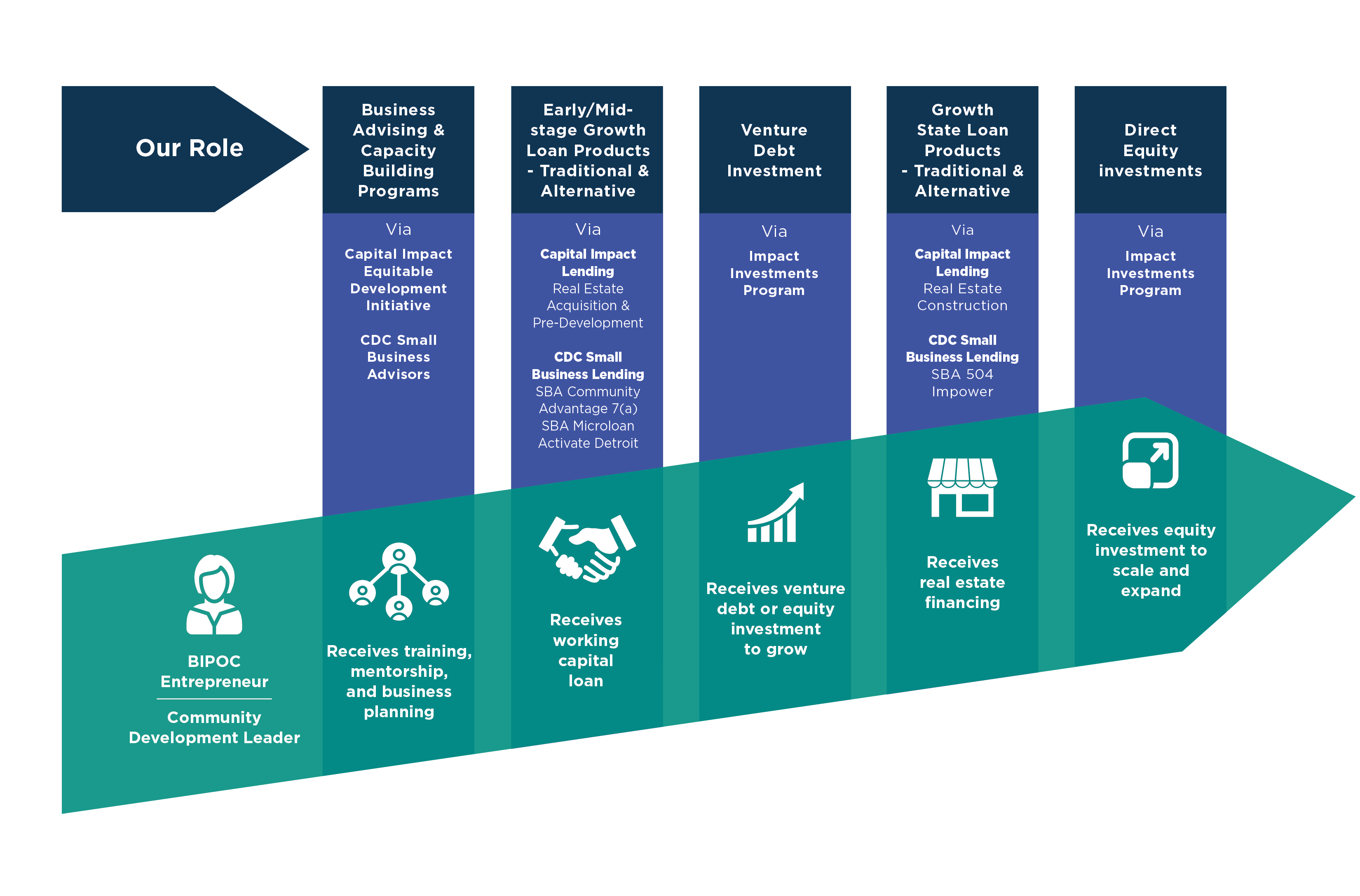

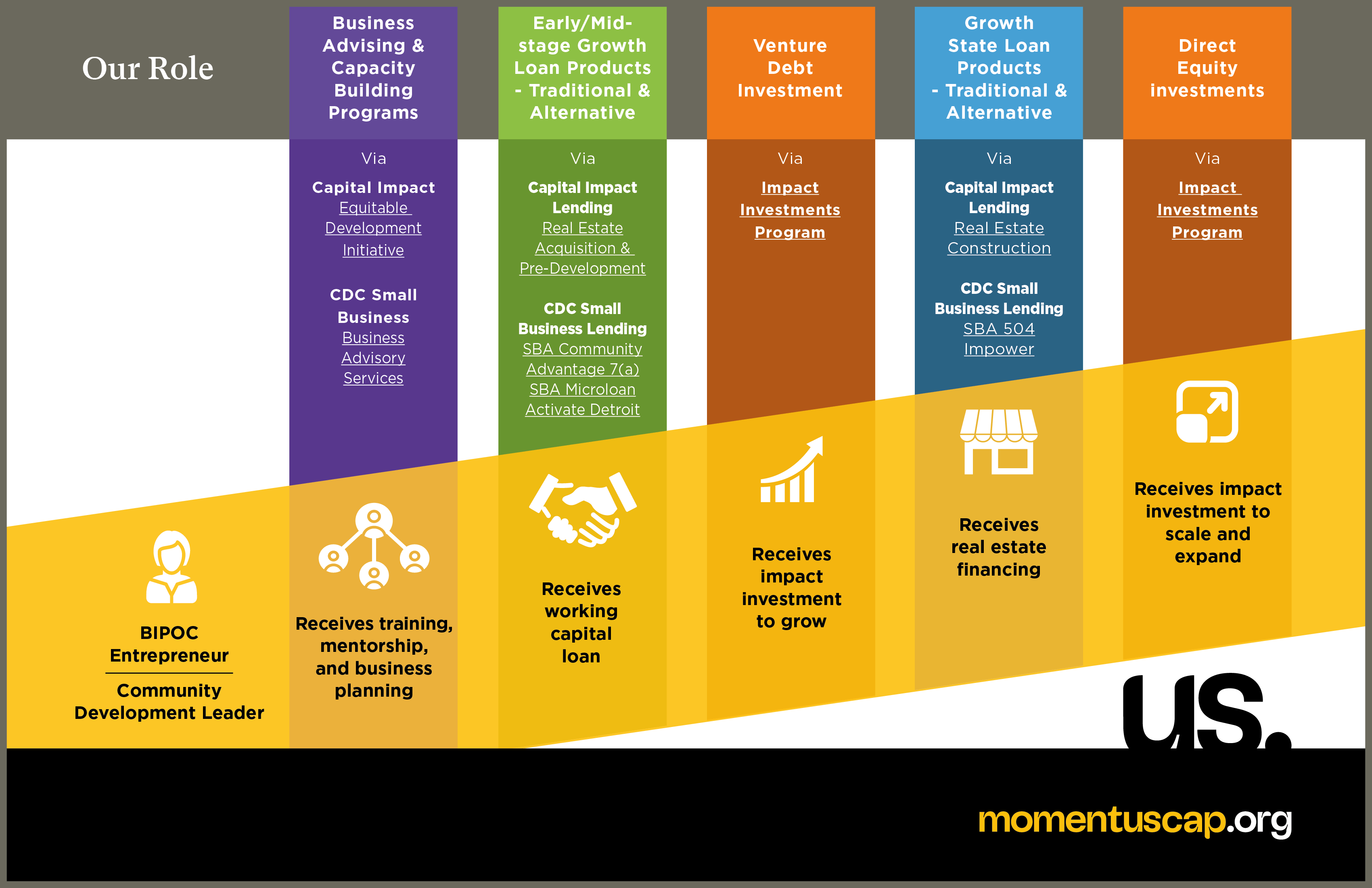

CDC Small Business Finance — an authorized lender under the program and non-profit organization — led the pack in both total loans and amount funded.

In fiscal 2017, CDC issued 127 Community Advantage loans — a 51 percent rise from last year. The total amount financed skyrocketed to $19.8 million this year. That’s an 88 percent increase from the same period last year.

Don’t qualify for bank financing? There’s still hope

Community Advantage loans go up to $250,000 and are available to new and existing firms that need working capital, equipment and tenant improvements, among other uses.

The program “meets an unmet need,” said Susan Lamping, the vice president of sales at CDC Small Business Finance. Loans in the $50,000 to $250,000 range can be “too big for microlenders and too risky for traditional banks,” she added. (Read more about the program here.)

Oftentimes, when banks are unable to provide the needed financing, they can refer their clients to CDC, which has more flexibility to help a broader group of borrowers.

In those situations, if a client ends up borrowing from CDC, they still retain all accounts, cards and merchant relationships with their bank — and only the business-loan portion would be handled through CDC.

This arrangement is beneficial for bankers because it “allows them to retain their relationship with their customers,” Lamping said.

What’s more, there’s the potential of CDC referring the business owner back to the bank for additional financing if the business experiences growth over the next couple of years.

Unlike traditional bank loans, Community Advantage loans are partially guaranteed by the SBA. This allows lenders such as CDC more flexibility to make loans that may not be available through traditional banks due to the risk level.

The loan program began as a pilot in 2011 to help business owners most heavily impacted by the Great Recession. CDC was among the first six community-based lenders accepted into the program.

What you need to qualify

Potential borrowers still have to demonstrate their ability to repay the full loan and meet other guidelines. Loans are determined on a case-by-case basis.

One of the main advantages of working with CDC loan officers is that they listen and consider your whole story instead of only focusing on the hard numbers.

Take a deeper dive into the Community Advantage Loan Program. Once you’re ready, tell our loan experts about your business, and they’ll work to match you with a financing plan that best suits you.