Members of the executive team at leading lender CDC Small Business Finance urged key lawmakers in Washington D.C. last week to tweak parts of an SBA 504 program, one of the agency’s flagship efforts, to improve the experience for would-be borrowers and lending partners.

This was part of the company’s annual legislative trip to the Hill with fellow mission-driven lenders. The series of meetings also involved drumming up support for a future proposal to make the successful pilot 7(a) Community Advantage program a permanent one.

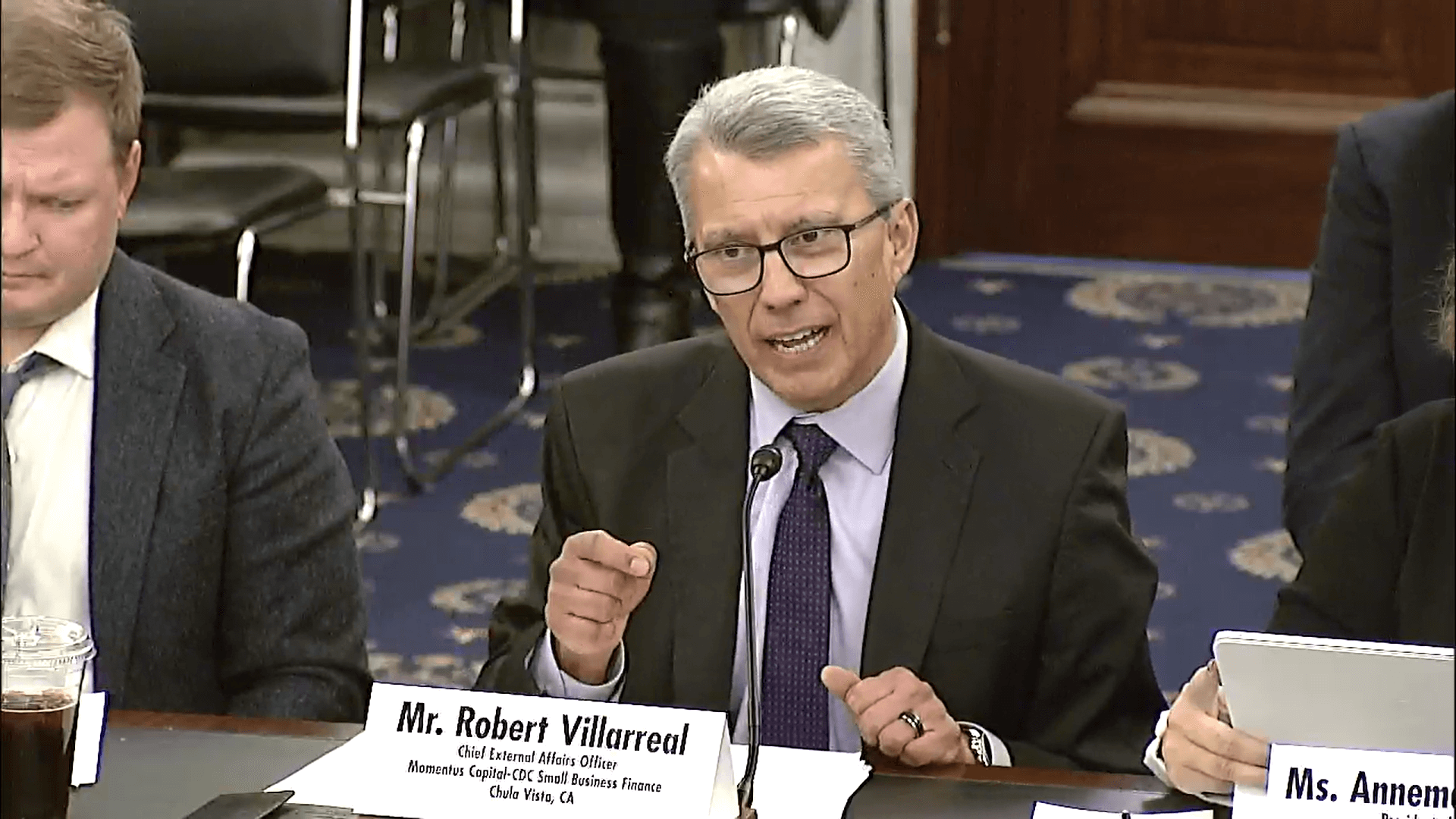

For at least 12 years, CDC Small Business Finance has teamed up with a coalition of other community development companies every spring to “educate and update our legislators” on the industry’s recent successes and high-impact growth opportunities, said Robert Villarreal, CDC Small Business’s executive vice president and head of its CDFI, or community development financial institution.

The main idea here is to attract support for future measures that will make lending to small business owners more widely available, one of the main drivers of mission-based lending.

Our annual trip to the Hill also coincides with the Spring Summit held by the National Association of Development Companies, or NADCO — a more than 200-member strong advocacy group of nonprofit lenders focused on fueling economic development by way of the SBA’s 504 real estate loan program. SBA Administrator Linda McMahon and other agency leadership also took part in the function.

“The Spring Summit is a great opportunity to engage with SBA leadership and Congress in our efforts to expand and improve the delivery of long-term capital to small business,” said Catherine Riddle, CDC Small Business Finance’s chief financial officer and vice chair of NADCO.

Our executive leadership team paused to share the biggest highlights from the conference and their meetings with legislators:

Takeaway #1: Recent SBA policy changes need reexamination. Are they too restrictive?

At the start of the year, the SBA made official a number of changes to the 504 loan programs SOP, or standard operating procedure. The updates included increasing the required down payment for certain borrowers, tightening eligibility requirements and increasing loan-applicant vetting, among others.

CDC Small Business Finance’s Chief Credit Officer Mike Owen, who was also part of the D.C. contingent, anticipated these updates would pose challenges to not just mission-based lenders, but also potential clients and the bank partners who complete the financing picture.

Some, he said, may have shied away from the SBA 504 loan product as a result of the increased scrutiny and regulatory burden. In speaking with others at the Spring Summit, Owen found other Certified Development Companies (CDCs) and banks expressing similar sentiments.

SBA 504 loans can be used to finance commercial real estate, major equipment, land and machinery. The federal program was designed to boost job creation and economic development. How? These loans allow entrepreneurs to invest in permanent homes for their businesses, and in turn, their employees and communities benefit and thrive.

In fiscal 2017 alone, the SBA approved more than 6,000 such loans totalling $5 billion and generating 60,578 jobs.

Owen says SBA 504 program deserves a hard look to ensure “it’s still fulfilling the mission it was set up to do,” in light of the recent SOP modifications.

“Does it continue to maintain its relevance?” he added.

Takeaway #2: The SBA 7(a) Community Advantage loan program should live on

Another focus of the D.C. trip involved canvassing support for a potential measure in the next year to make the SBA 7(a) Community Advantage program a permanent one.

Launched in 2011 as a pilot, the loan is an ideal choice for startups and existing businesses seeking $20,000 to $250,000 in affordable business capital. This is the type of financing that may not be available through traditional banks due to size and risk.

The program benefits borrowers in many ways. Not only are they building their credit history, they can also receive free business advising as part of the loan. And like in the SBA 504 program, the success of the borrower trickles down to the community in which they’re based.

“By all accounts, the SBA 7(a) Community Advantage program has exceeded expectations in terms of loan volume and dollars. It’s also succeeded in getting capital into the hands of those need it the most,” Villarreal said.

The downside is, the program is due to sunset in 2020. While that may seem like a ways away, establishing its permanence soon would help encourage more lenders, “especially those in the sidelines,” to issue more of these loans to help get capital into more hands, Villarreal said.

Takeaway #3: Annual D.C. trip is a top priority

CDC Small Business Finance is no stranger to the Hill. With our peers over the years, we have forged and maintained relationships with legislators and their top aides in the nation’s capital to advance the interests of small business owners and those who help them succeed.

In fact, the SBA 7(a) Community Advantage program was made possible in part to CDC Small Business Finance’s advocacy more than seven years ago. We were one of the first six lenders to take part in the program.

Also, the idea for the new SBA 25-year debenture was part of a large-scale effort by trade group NADCO to make the 504 loan program more relevant in today’s lending marketplace. CDC Small Business Finance also played a part in this endeavor.

Are you looking for capital for your small business? You can trust in our experienced loan officers to help you navigate the loan process with efficiency, ease and care.

Tell our loan experts about your business, and they’ll work to match you with a financing plan that best suits you. Let’s talk! Reach us at loaninfo@cdcloans.com.

In case you missed it: