Ellis Carr named new CEO of CDC Small Business Finance

We are excited to announce and welcome Ellis Carr as the new CEO of CDC Small Business Finance. Ellis will also continue to be the President and CEO of Capital Impact Partners, one of the nation’s leading Community Development Financial Institutions (CDFI).

Ellis will lead the two organizations, who are uniting operations, to launch a transformative new enterprise and innovate how capital and investments flow into historically disinvested communities to advance economic empowerment and equitable wealth creation.

Leveraging 80 years of combined experience, nearly $3 billion in assets, and strong ties to both large financial institutions and community-based organizations, Capital Impact Partners and CDC Small Business Finance are now operating as one under Ellis’ leadership.

Gratitude to Kurt Chilcott

Kurt Chilcott will transition from President and CEO of CDC Small Business Finance and continue his support of this vision by serving as Chair of both Capital Impact Partners and CDC Small Business Finance’s Boards.

We extend heartfelt thanks and gratitude to Kurt who has been the steward of CDC Small Business Finance for the past 23 years. Under his leadership, the organization has been one of the nation’s leading mission-based small business lenders and has continuously evolved to meet the needs of small business owners.

Addressing Systemic Issues Facing Communities

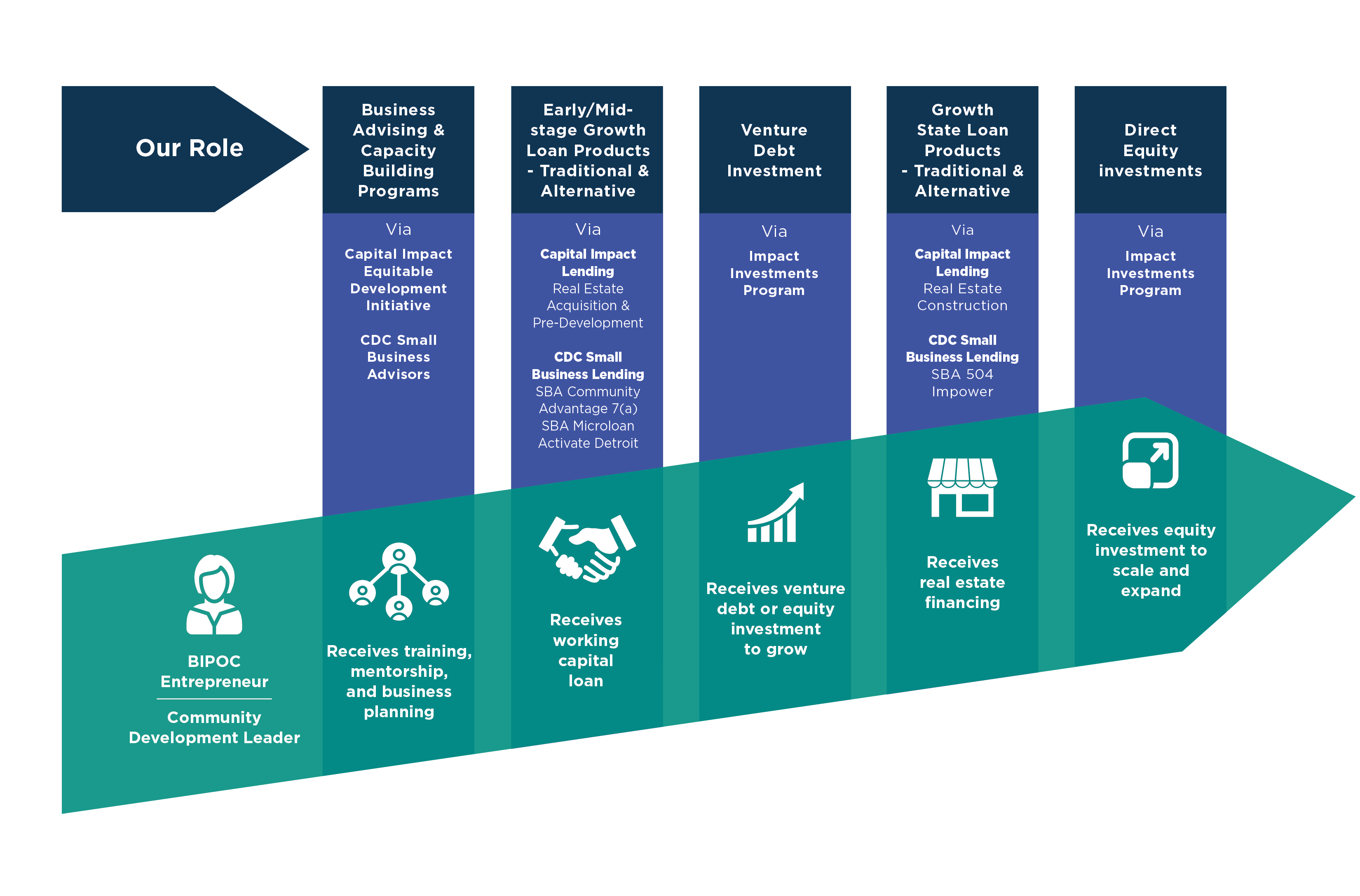

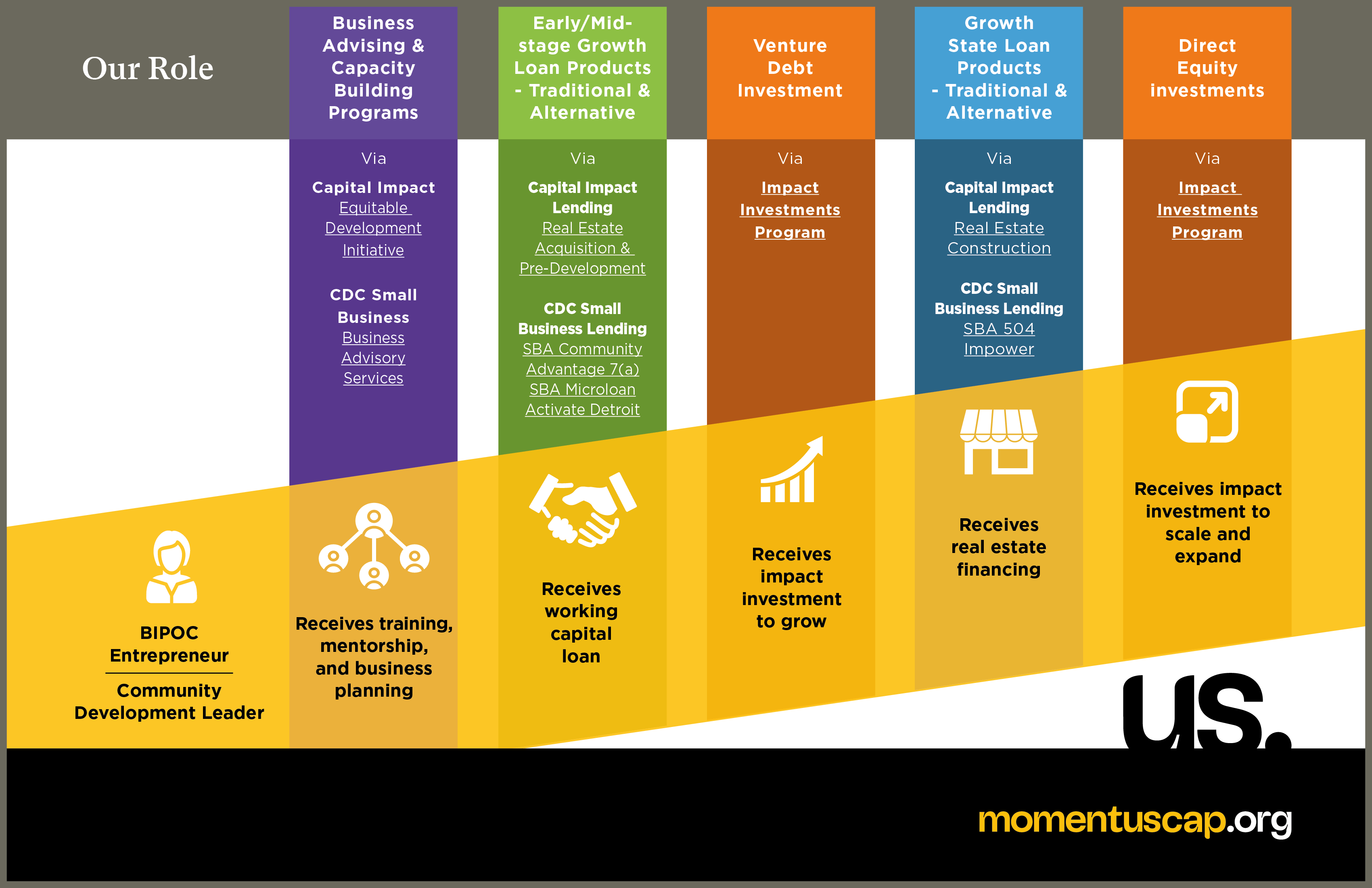

Ellis will manage the new enterprise under one national strategy designed to drive a holistic place-based approach to community and economic development at scale, centered around people and place, to address key systemic issues that communities face:

- Growth of Economic Inequity

Current financial structures do not provide equitable opportunities or outcomes as the racial wealth gap grows - Lack of Place-Based, Community-Led Solutions

Trusted organizations that listen to and value community-led solutions, and offer relevant place-based lending and investment products and services are currently lacking - Disconnected Supply & Demand of Capital

Institutional investors and community organizations are currently disconnected from efficiently leveraging the supply and demand of capital investments to drive real and scalable impact

This unusual coming together between leaders in the CDFI and Small Business sectors is driven by the need to shake-up the traditional tools and approaches that have failed to address systemic issues of inequality, economic empowerment, and the widening racial wealth gap.

With experience delivering a full suite of products and services and an established position as advocates in Washington, D.C., the new operating model is uniquely suited to unleash solutions for communities that will break down longtime barriers to success.

Continued Commitment to Commercial Real Estate and Working Capital Lending

CDC Small Business Finance’s commitment and leadership in SBA 504 commercial real estate and working capital lending will continue to be at the core of our work. We are excited to bring our complementary expertise together with Capital Impact Partners which will serve to further elevate our reach and impact for the small business community.

To learn more about how you can join this effort and to see the press release, please visit www.investedincommunities.org