Can the almighty SBA 504 loan do more?

For decades, the SBA 504 loan program has brought unquestionable value to small business owners and local economies nationwide.

The U.S. Small Business Administration’s flagship program has empowered tens of thousands of entrepreneurs to buy commercial real estate and the major equipment churning out their products. Through community lenders like CDC Small Business Finance, billions of dollars in these long-term, below-market loans have generated more than 2 million jobs. It’s the only loan program around that’s connected to job creation especially in underserved communities.

With this type of momentum and impact, it is more important than ever to explore if the SBA 504 can do even more, and if so, what would it take?

Related: Should I refinance into an SBA 504 loan?

We’ve thought long and hard about this topic, as one of the largest SBA 504 lenders in the nation and an active member of the National Association of Development Companies. Also known as NADCO, it’s a 200-member group of community lenders (or community development companies) who advocate for the SBA 504 loan program.

“Over the last 20-plus years, the SBA 504 program has had a tremendous impact on small business and economic development,” said Cat Riddle, CDC’s chief financial officer and NADCO’s vice chair.

“The partnership of NADCO and the overall community of CDCs is proud of these accomplishments. And together, our aim to ensure the program’s impact continues to be amplified,” she added.

Here are some SBA 504-related opportunities that would reflect positive change in the community-lending industry:

Opportunity #1: Streamline the process to increase speed, predictability.

Modern-day consumer habits tell us small business borrowers are increasingly choosing speed over longer-term savings, yet many do not realize the true cost of their “fast” financing. This signals the need to speed up the 504 loan process to match what customers are craving and to increase education to ensure entrepreneurs understand the true terms and conditions of their loan.

Today, small business owners can get funded in a matter of days for upward of $500,000 by business lenders who deal exclusively in the digital space. But many of these deals come with a pricey catch.

Over time, they may be on the hook for sky-high interest rates of 50% APR to 150% APR. This may not be readily apparent due to the frequency and manner in which they are repaying the loan. For comparison, as of April 2019, the effective fixed rate for a 20-year SBA 504 loan is about 4.58%.

Related: What are the benefits of an SBA 504 loan?

Some time-trimming opportunities include:

The SBA could delegate more independent authority to community lenders. It’d make sense for the SBA to delegate any non-urgent review to solely the community lenders, which could eliminate many backlogs. This could also save time and help small business owners move closer to their funding,

Streamlining the routine legal-review process in each closing. This could entail a “priority” designation awarded to CDCs who have a long track record of producing issue-free loan packages and also have a designated attorney. Those with this designation would not have to undergo as thorough of an SBA review or be required to produce documents outside of what’s on the official closing checklist. Again, faster processing equals a happy borrower client.

Opportunity #2: Fully implement the modernization plan

The CDC industry as a whole has discussed a series of proposals that would help the SBA 504 evolve. We especially stand behind the following ideas to make the process better than ever:

- Reducing or consolidating forms: Consolidating any forms that have redundancy to improve efficiency.

- Eliminating data-entry errors: Keyboard mis-strokes happen to even the best of us. To minimize these errors, data validation could be introduced in forms particularly for the eligibility analysis.

- Standardizing the closing process. Align closing due dates across all offices for consistency.

- Incorporate more technology in the loan process. From enabling electronic signatures throughout the loan-funding process to having an online tracker for any required non-SBA documents that have been approved by an SBA attorney are several technology tools that will improve speed and efficiency.

Related: Should I get more than one SBA 504 loan?

Opportunity #3: Create a faster track for smaller-dollar deals.

Whether it’s a $5 million SBA 504 loan or a $500,000 one, the process to fund either is currently the same.

Smaller-dollar loans tend to be less complicated and time-consuming to process. To address this and provide borrower clients with more speed, it makes sense to establish an expedited track for SBA loan requests that are $500,000 or less.

Why is this important to small businesses?

With changing consumer habits and demands, we as lenders and advocates understand that we need to move with those changes.

Today’s client is looking for speed, transparency and predictability. Working together to bring the best possible SBA 504 product to small business owners is at the forefront of our industry. We believe we can achieve this goal with the steps noted above while keeping the SBA 504 product an affordable one that bolsters small businesses and the communities they serve.

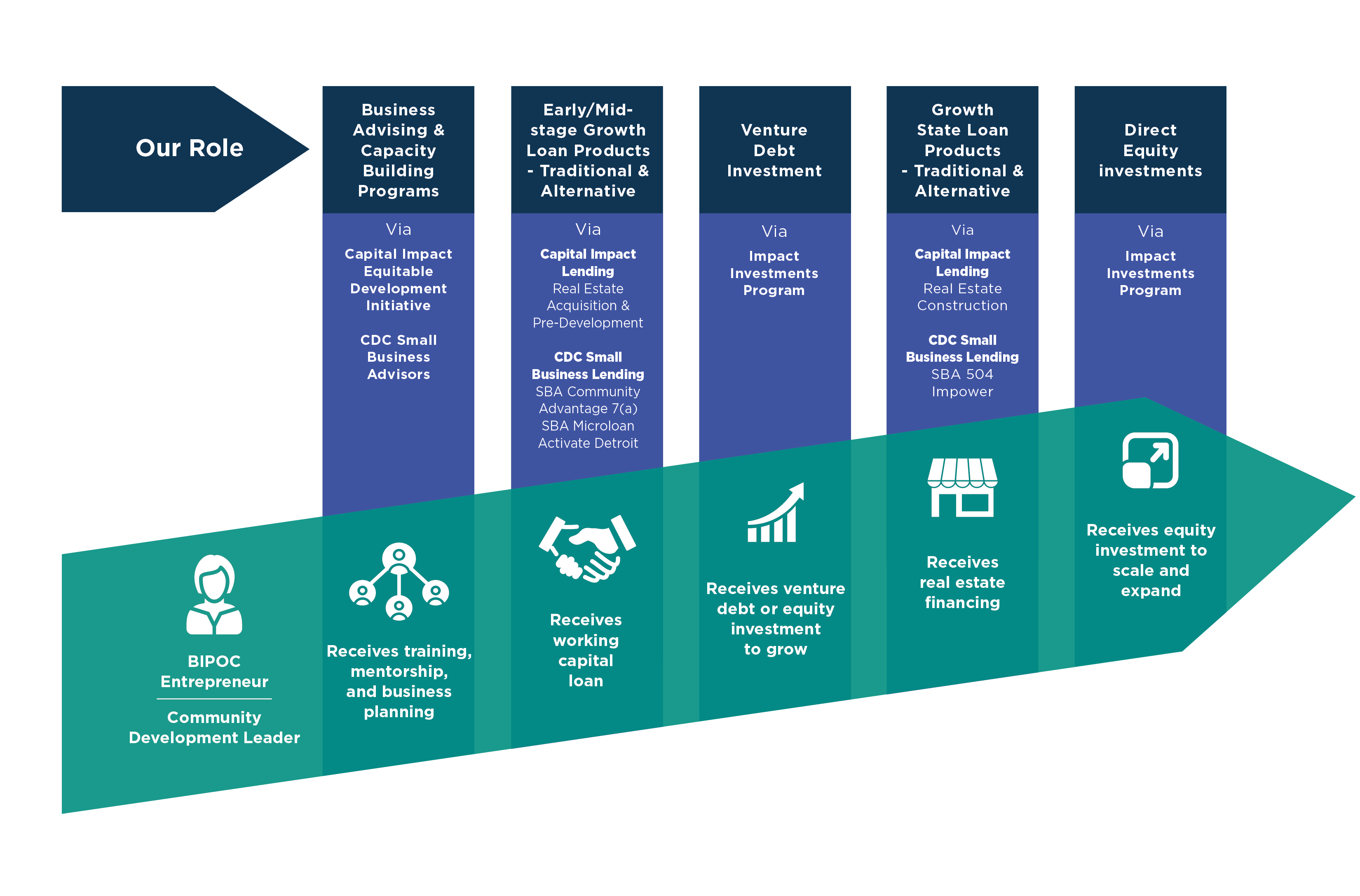

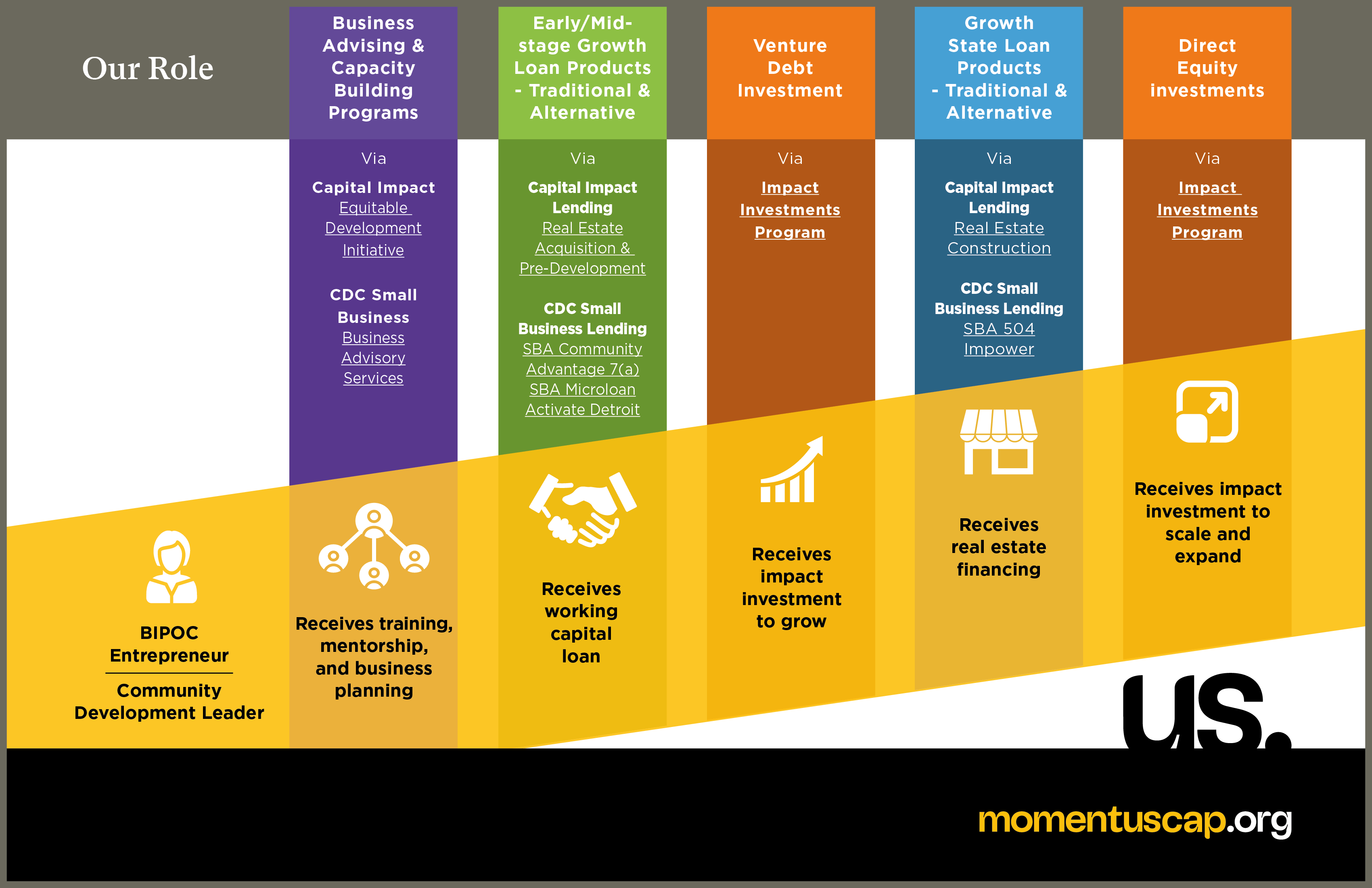

CDC Small Business Finance is the No. 1 SBA 504 lender in the nation and a trusted, award-winning nonprofit. We’re committed to your long-term business success by offering long-term, fixed rate financing for your building, major equipment or land purchases.

Tell our loan experts about your business, and they’ll work to match you with a financing plan that best suits you. Let’s talk! Reach us at loaninfo@cdcloans.com or (619) 243-8667.

In case you missed it:

- Transformative kickboxing studio springs to life with SBA business loan

- Top 3 Reasons Small Businesses Should Buy A Building

- What is CDC Small Business Finance reading? Bestsellers we couldn’t put down

- Should I refi my commercial real estate loan with an SBA 504 loan?

- Last-minute Tax Prep Tips for Your Small Business